Basic Islamic Banking Concept

Balancing material pursuits and spiritual needs.

Basic islamic banking concept. There are more than 300. Following are some basic concepts of islamic banking system. In islam economic activity conducted according to sharia is itself an act of worship. Islamic economics is based on core concepts of balance which help ensure that the motives and objectives driving the islamic finance industry are beneficial to society.

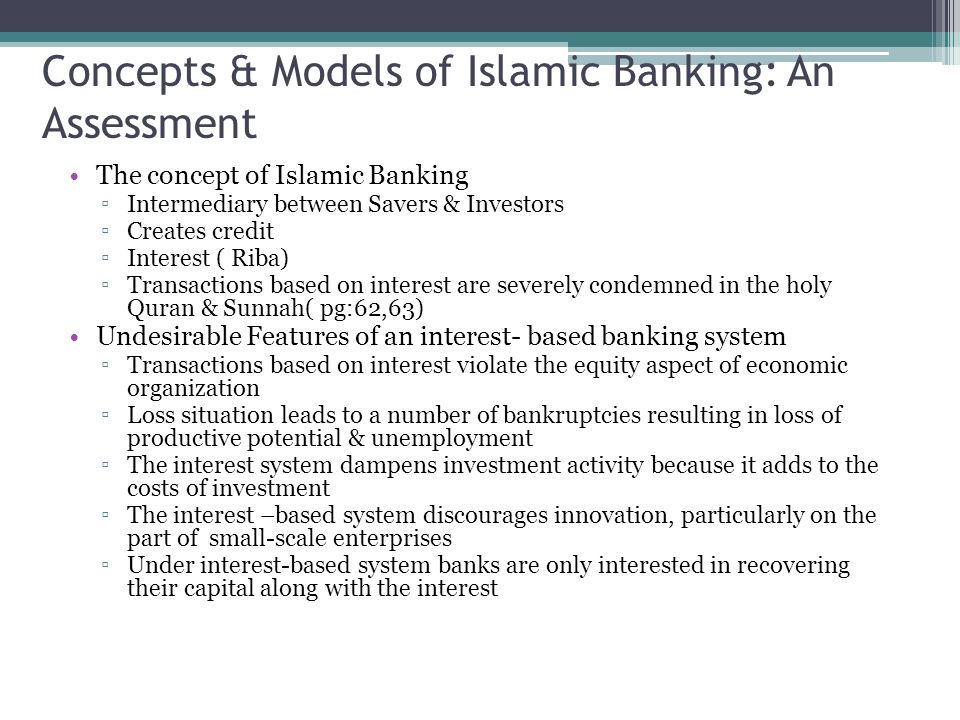

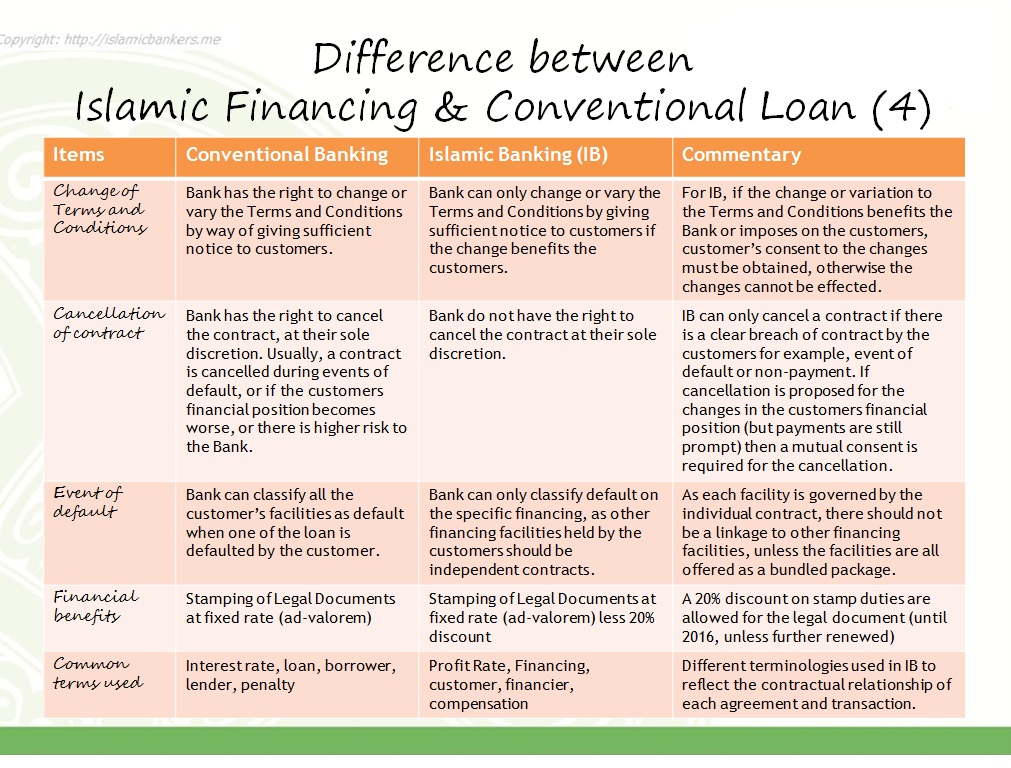

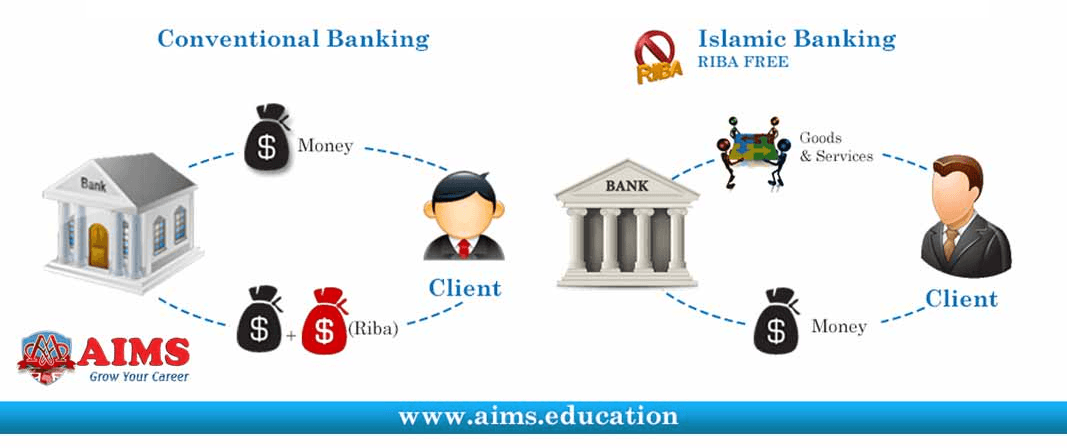

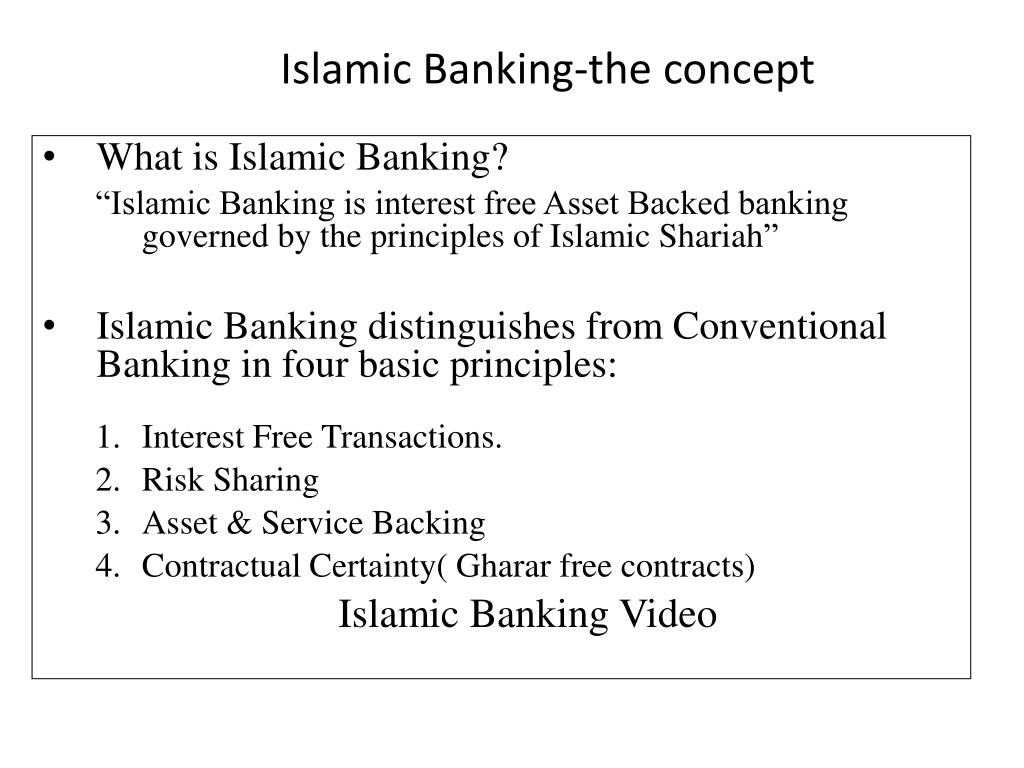

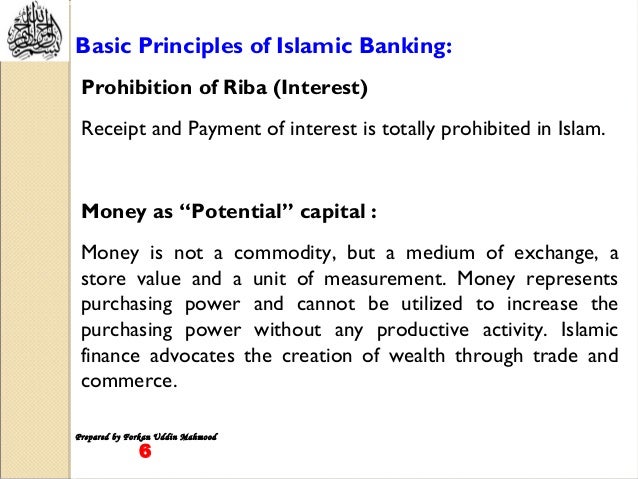

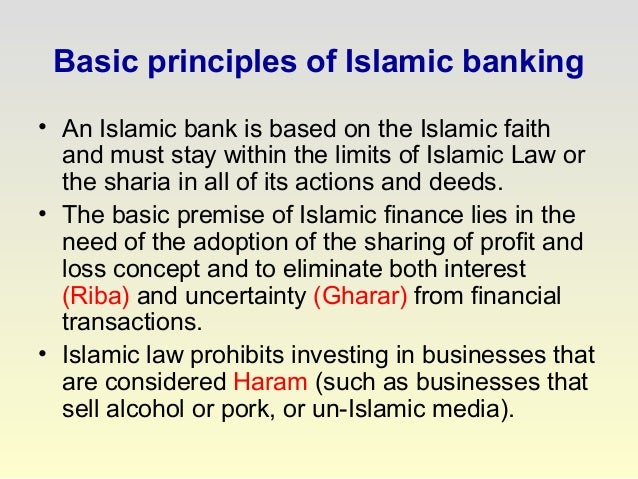

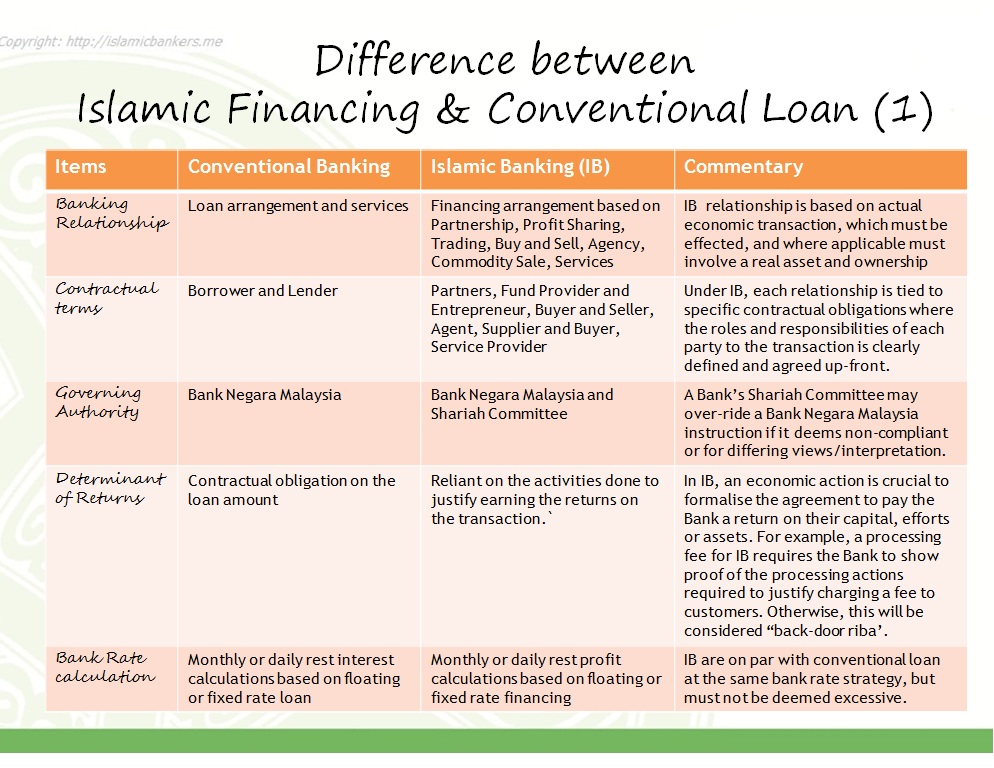

Conventional banking is essentially based on debtor creditor relationship between depositors and the bank in the one hand and between the borrowers and the bank on the interest is considered as the price of credit reflecting the opportunity cost of money. The basic concept of islamic banking uldana abdimanapova. Islamic banking principles the basic principle of islamic banking is based on risk sharing. Interest being the cogwheel of the modern banking is strictly prohibited in islam and hence.

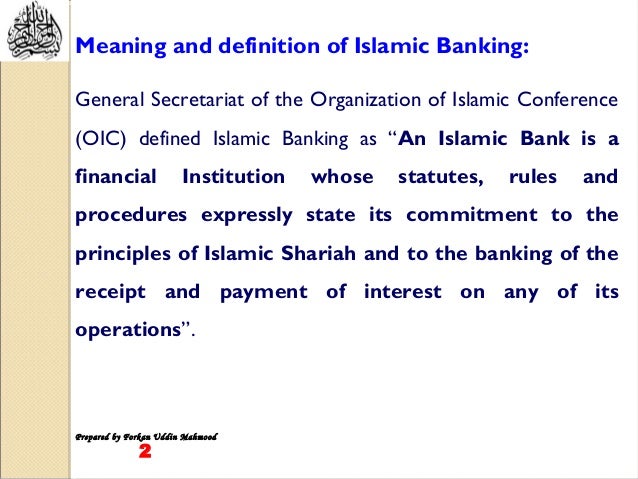

A bank is the establishment for the custody of money received from or on behalf of its customers. Theoretical basis of the concept of islamic banking. Two fundamental principles of islamic banking are the sharing of profit and loss and the prohibition of the collection and payment of interest by lenders and investors. What is islamic banking.

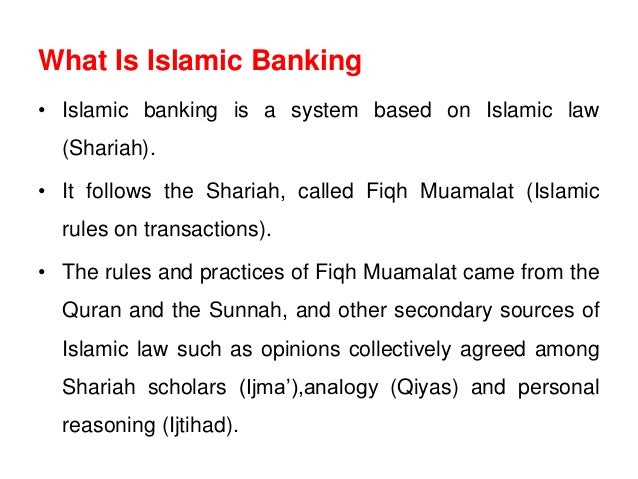

Banking in islam is a saving money framework that depends on the standards of islamic law additionally known as shariah law and guided by islamic financial matters. The fundamental principle of islamic banking is based on the bank s direct involvement in transactions financed by it. Sharia forbids the fixed or floating payment or acceptance of specific interest rates or fees known as riba. Islamic banking or islamic finance arabic.

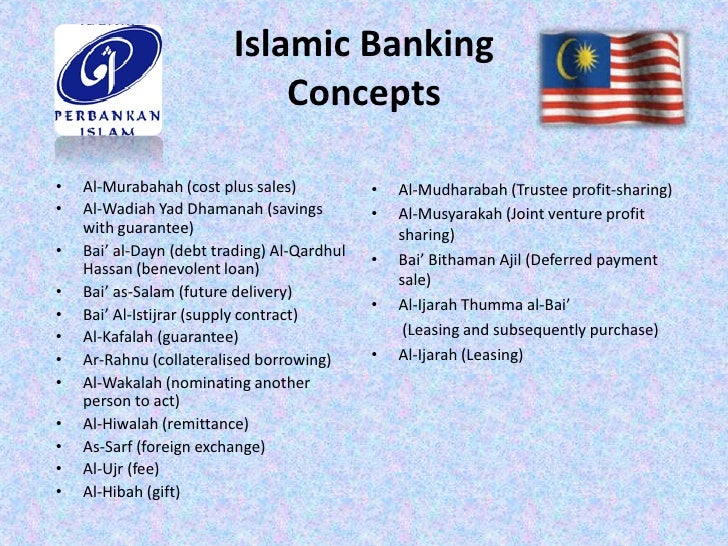

This is viewed as a component of trade as opposed to a risk transfer which is how conventional banking is regarded. It endorses on interest free debt and denies effortless profit as it is regarded as premium or interest and curse in islam islamic banking in usa. مصرفية إسلامية or sharia compliant finance is banking or financing activity that complies with sharia islamic law and its practical application through the development of islamic economics some of the modes of islamic banking finance include mudarabah profit sharing and loss bearing wadiah safekeeping musharaka joint.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)