Benefit In Kind Malaysia 2019

2 2004 issued on 8 november 2004.

Benefit in kind malaysia 2019. These benefits are called benefits in kind bik. The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing. A further clarification on benefits in kind in the form of goods and services offered at discounted prices. Accommodation or motorcars provided by employers to their employees are treated as income of the employees.

These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. 15 march 2013 pages 3 of 31 b any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. Perquisites are taxable under paragraph. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable.

Inland revenue board of malaysia benefits in kind public ruling no. Objective the objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Medical and transport allowances and benefits in kind such as cars personal drivers accommodation and so on. Perquisites means benefits that are convertible into money received by an.

If the amount exceeds rm6 000 further deductions can be made in respect of amount spent for official duties. Employment income is regarded as derived from malaysia and subject to malaysian tax where the employee. 11 2019 date of publication. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Income attributable to a labuan business. 19 benefits in kind exemptions. And one should also be awar. Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc.

Tax exemption limit per year petrol travel toll allowances. 12 december 2019 page 1 of 27 1. Application to talent corporation malaysia berhad from 1 january 2018 to 31 december 2019. If you want to find the answer to whether or not your rm100 monthly travel allowance is tax exempt.

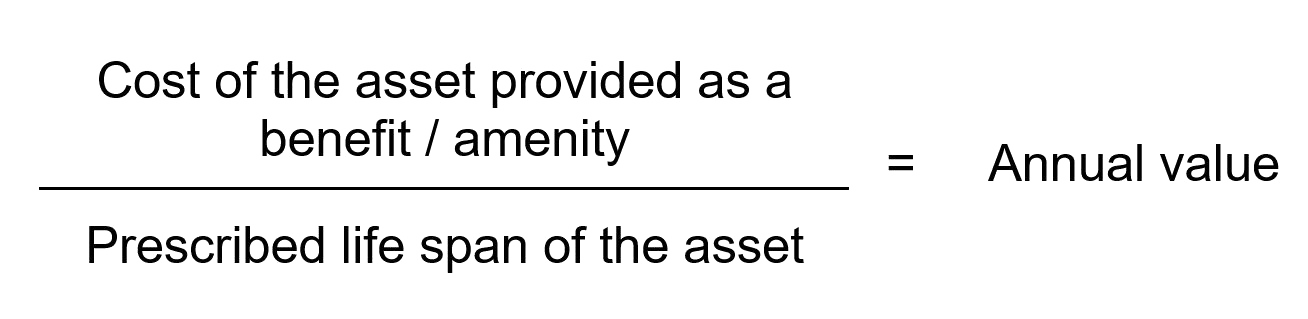

Inland revenue board of malaysia benefits in kind public ruling no. Motorcar and petrol driver gardener etc. 5 2019 inland revenue board of malaysia date of publication. There are several tax rules governing how these benefits are valued and reported for tax purposes.

Certain benefits in kind pertaining to consumable services are not eligible for taxation.