Benefit In Kind Malaysia 2020 Car

Petrol powered and hybrid powered cars for the tax year 2020 to 2021.

Benefit in kind malaysia 2020 car. Generally non cash benefits e g. With effect from ya 2020. List of benefits in kind granted administrative concession or exempt from tax. These benefits are called benefits in kind bik.

11 2019 date of publication. Inland revenue board of malaysia benefits in kind public ruling no. Where an employee has 2 or more cars made available at the same time see chapter 12 paragraph 12 37. The april 2020 car tax changes have been a welcome relief to company motorists with planned changes of zero percent benefit in kind payment for company car drivers with electric vehicles.

12 december 2019 page 4 of 27 5 2 4 the value of bik based on the formula method provided to the employee by the employer can be abated if the bik is a provided for. Therefore for a pure electric vehicle with zero tailpipe emissions company car drivers will be taxed at 0 and pay no tax on the benefit in kind bik at all. 19 benefits in kind exemptions certain benefits in kind pertaining to consumable services are not eligible for taxation. There are several tax rules governing how these benefits are valued and reported for tax purposes.

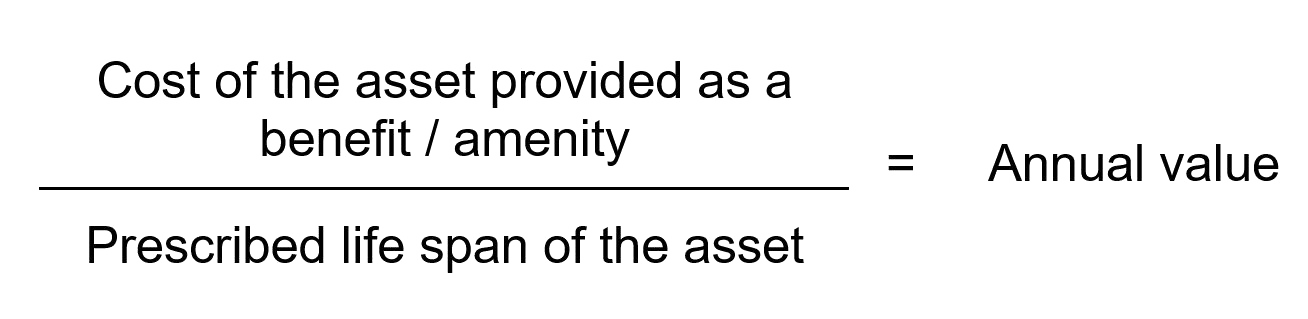

Inland revenue board of malaysia benefits in kind public ruling no. For cars newly registered from 6 april 2020 the majority of company car tax rates will be reduced by two percentage points. Under this method each benefit provided to the employee is ascertained by using the formula below. Fully electric vehicles saw benefit in kind tax in 2020 21 dropping to 0.

3 2013 date of issue. It makes the arguments for a company car alternative look shaky at the very best. And then rising to 1 the following year and then 2 through to april 2025. The formula method 6 2 1.

Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. It provided its employee with this car since 1 january 2015. And one should also be awar.

Best company cars to take advantages of the benefit in kind changes with in 2020 new rules coming in are cutting the cost of company car tax dramatically for electrified models and these are the best cars to beat the tax changes with. Those april changes to benefit in kind taxation were really significant.