Benefit In Kind Malaysia 2020

3 2013 date of issue.

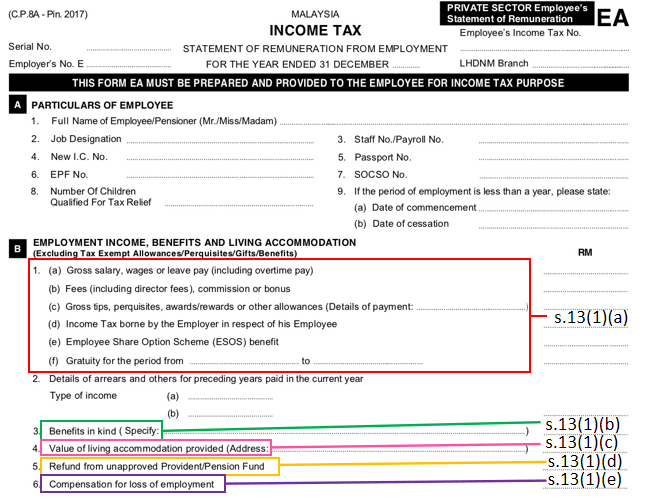

Benefit in kind malaysia 2020. 2 2004 issued on 8 november 2004. These benefits are called benefits in kind bik. Inland revenue board of malaysia benefits in kind public ruling no. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no.

The benefits must be made available to all staff. Benefits perquisites relating to employee s health free or subsidised a outpatient treatment b hospitalisation c dental. Ya 2007 outside malaysia not exceeding one passage in any calendar year subject to a maximum of rm3 000. A further clarification on benefits in kind in the form of goods and services offered at discounted prices.

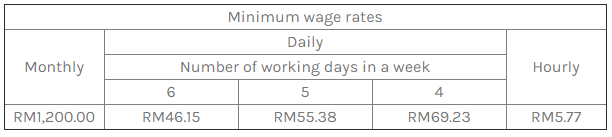

Service charges and other bills e g. From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia. Child care facilities benefits. Medical dental benefits.

Household furnishings apparatus appliances. 11 2019 date of publication. Perquisites means benefits that are convertible into money received by an. Benefits perquisites given to promote creativity and innovation.

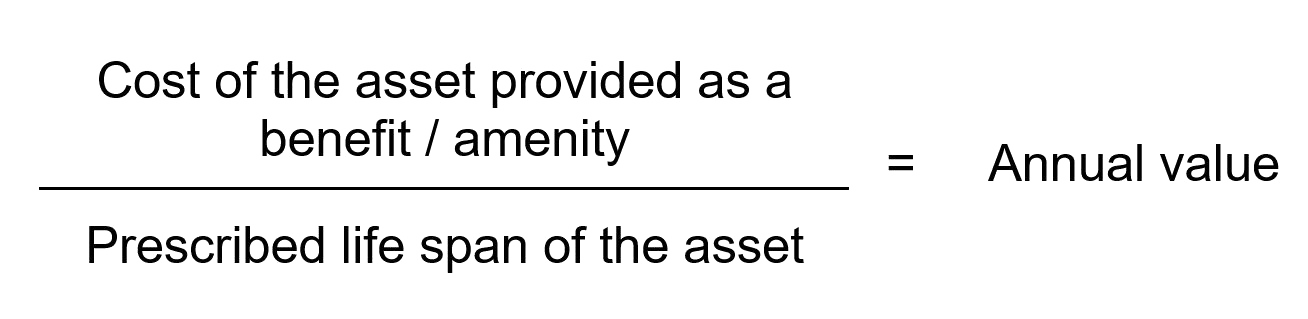

Semi furnished as above and with air conditioners or carpets or curtains. There are several tax rules governing how these benefits are valued and reported for tax purposes. Semi furnished with furniture in the lounge dining room and bedroom. Individual income tax exemption of up to rm5 000 to employees who receive a handphone notebook or tablet from their employer effective july 1 2020.

2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Within malaysia not exceeding three times in any calendar year up to ya 2006 within malaysia no limit wef. 2020 malaysia benefits summary 2020 malaysia benefits summary employees are eligible for most benefits programs on the first day of employment. Generally non cash benefits e g.

This concession refers only to the medical bills of the employee employee s spouse and children. 12 december 2019 page 4 of 27 5 2 4 the value of bik based on the formula method provided to the employee by the employer can be abated if the bik is a provided for. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. Inland revenue board of malaysia benefits in kind public ruling no.

Real property gains tax rpgt exemption for malaysians for disposal of up to three properties from june 1 2020 to december 31 2021. Ya 2008 leave passages. Water electricity charges and bills paid by employer.