Benefit In Kind Malaysia Car

Motorcar and petrol driver gardener etc.

Benefit in kind malaysia car. Motor cars provided by employers are taxable benefit in kind. Benefits in kind fourth addendum to public ruling no. Inland revenue board of malaysia benefits in kind public ruling no. A further clarification on benefits in kind in the form of goods and services offered at discounted prices.

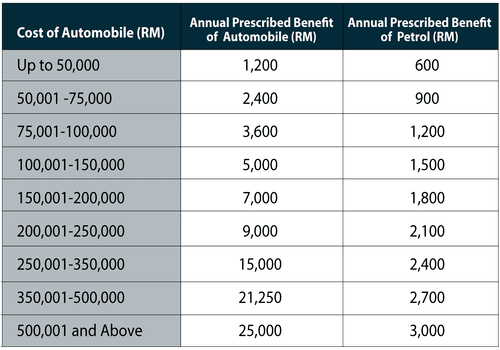

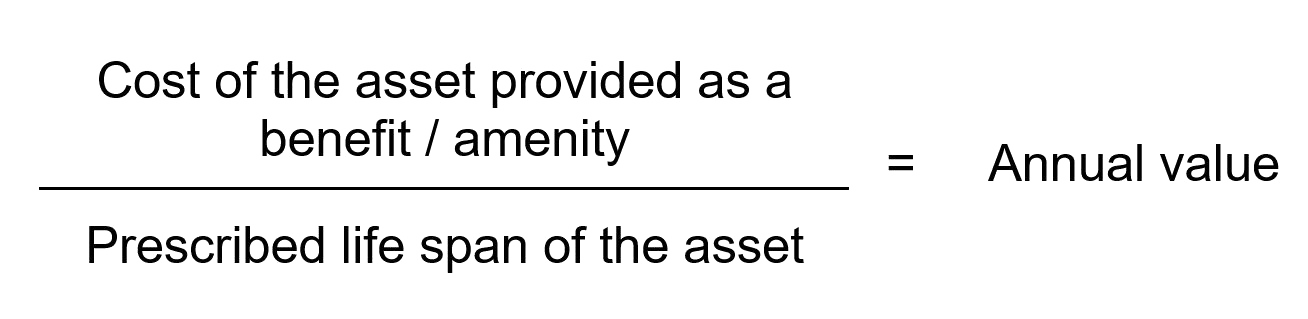

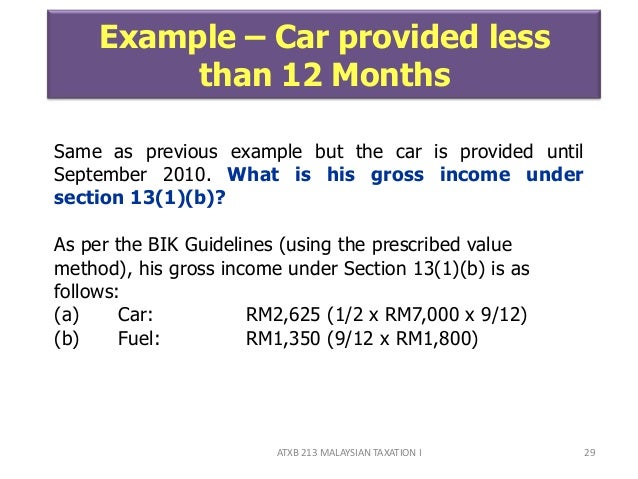

Here are the 14 tax exempt allowances gifts benefits perquisites. B refers to the remaining period from the date of purchase of the car to the date of expiry of the coe or the renewed coe if the second hand car is more than 10 years old at the time of purchase. Based on formula or prescribed value method. So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit.

Types of benefits comments. Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Inland revenue board of malaysia benefits in kind public ruling no. The benefits should be available to all staff in order to achieve the objective of fostering good relationship among the staff and it is difficult to assign a specific value to each employee.

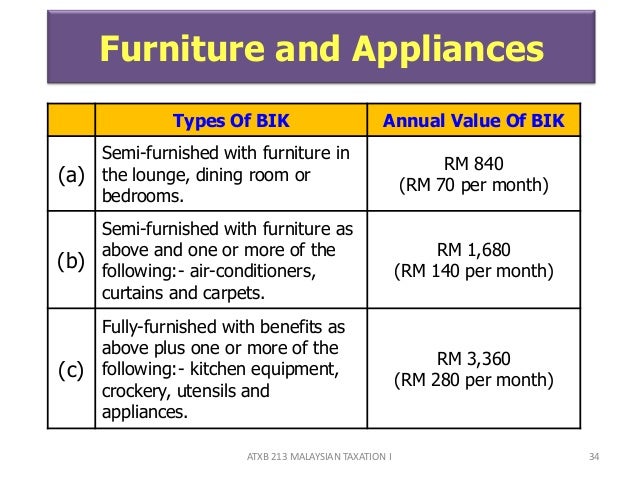

2 2004 issued on 8 november 2004. Housing accommodation unfurnished employee or service director. Certain benefits are exempted from tax. Please refer to benefits in kind below.

15 march 2013 pages 1 of 31 1. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Benefits that foster goodwill or promote camaraderie among staff. 3 2013 date of issue.

Directors of controlled companies. 2 2004 inland revenue board malaysia date of issue. Using the formula method the annual value of benefit in kind bik in respect of the car which is taxable as part of joey s gross income from employment is as follows. 11 2019 date of publication.

A car which is provided to the employee is regarded to be used privately if. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. The bik of rm20 500 would be reported in joey s form ea and he is liable to pay tax on the bik received from the employer. 19 april 2010 issue.

A fourth addendum page 2 of 4 the annual value of benefits in kind on car and petrol for the year of assessment 2007 is computed as follows. Car cost refers to the actual cost of the car inclusive of coe paid or payable by the employer at the date of purchase.