Benefit In Kind Malaysia Tax

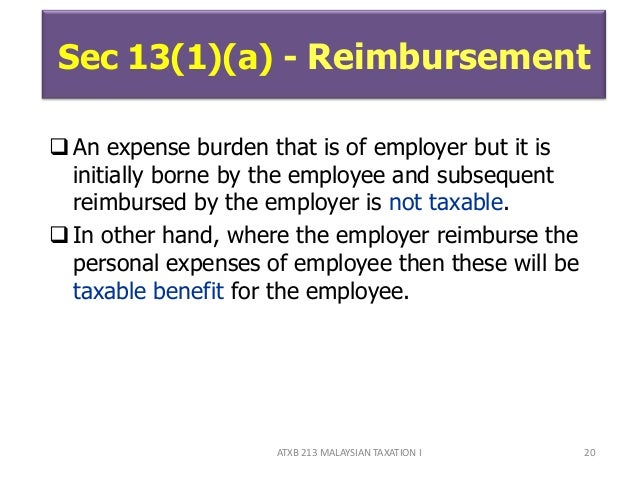

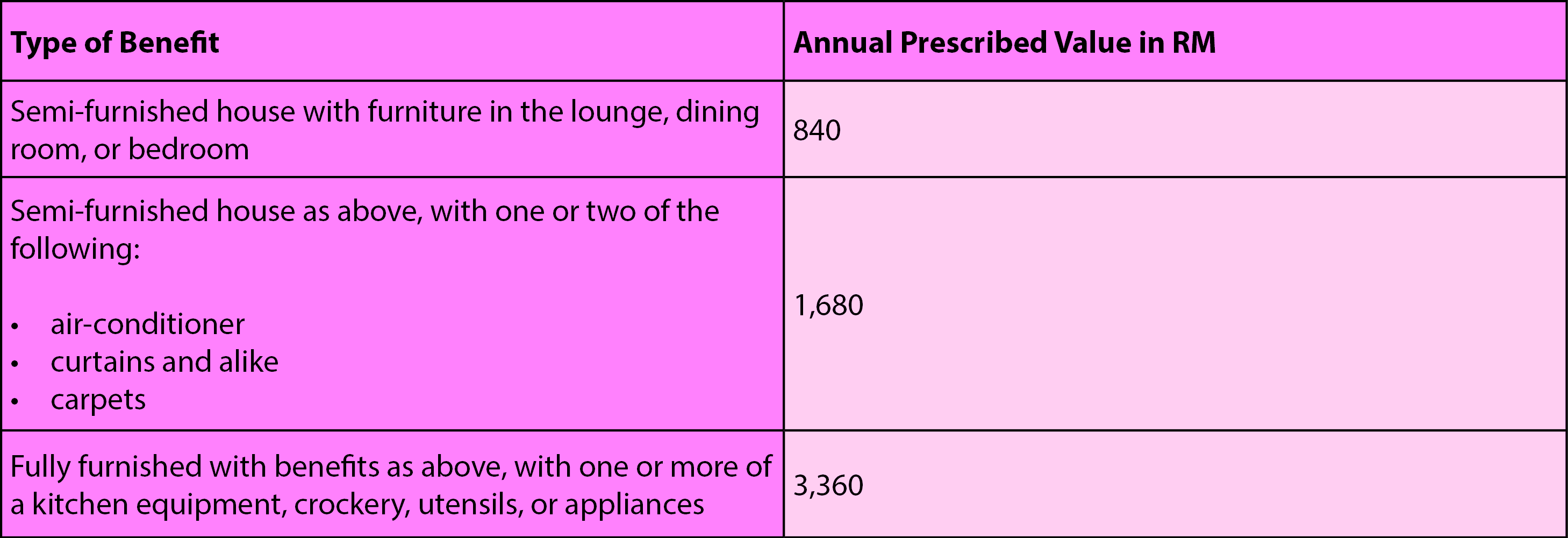

Tax exemption on benefits in kind received by an employee 2 1 benefits in kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from employment under paragraph 13 1 b of the income tax act 1967 ita.

Benefit in kind malaysia tax. Income attributable to a labuan business. Overseas not more than once a year with tax exemption limit of rm3 000. Benefits used by employer to perform his. In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company.

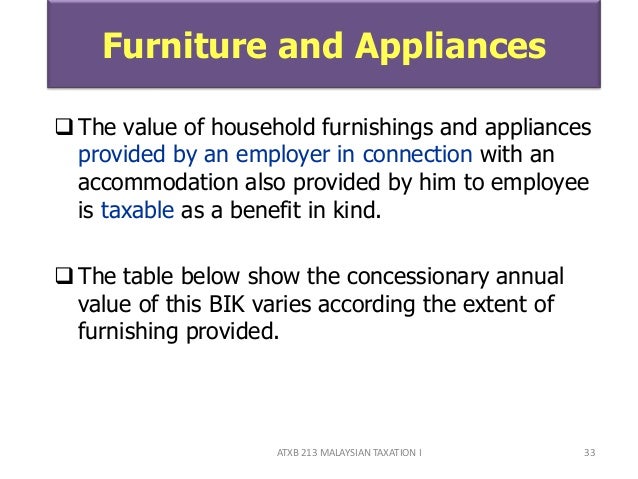

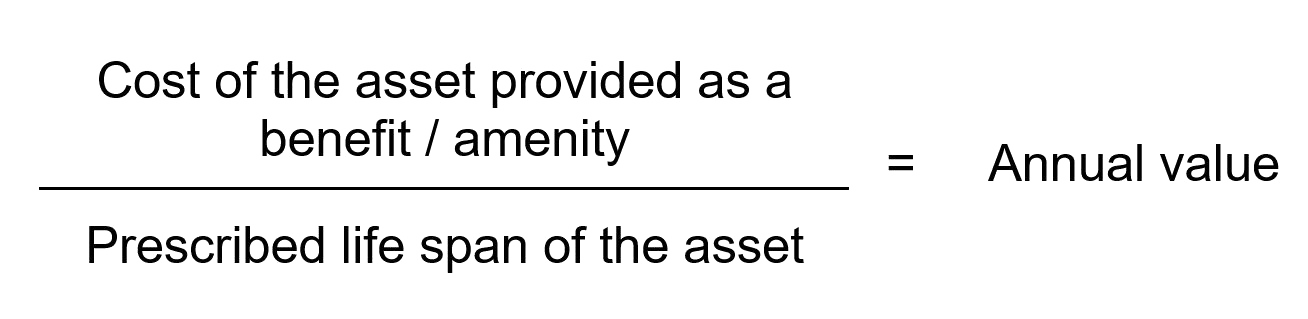

3 2013 date of issue. Objective the objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. And one should also be awar. Accommodation or motorcars provided by employers to their employees are treated as income of the employees.

Motorcar and petrol driver gardener etc. Employment income is regarded as derived from malaysia and subject to malaysian tax where the employee. Provided to employee and immediate family only. There are several tax rules governing how these benefits are valued and reported for tax purposes.

12 december 2019 page 1 of 27 1. Tax exempt for travel. Here are the 14 tax exempt allowances gifts benefits perquisites. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Certain benefits in kind pertaining to consumable services are not eligible for taxation. In malaysia not more than three times a year. Perquisites benefits in kind and tax exemptions a perquisite is a perk or benefit given to you by your employer like travel and medical allowances.

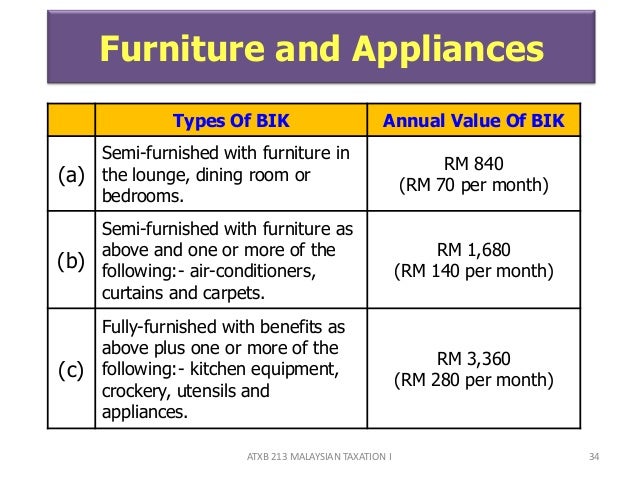

11 2019 date of publication. These benefits are called benefits in kind bik. Petrol allowance petrol card travelling allowance or toll payment or any combination. 2 2 however there are certain benefits in kind which are either exempted from tax.

Group insurance premium to cover workers in the event of an accident. 15 march 2013 pages 1 of 31 1. Certain benefits are exempted from tax. Inland revenue board of malaysia benefits in kind public ruling no.

Generally non cash benefits e g. Benefits in kind are also a type of benefit received by employees which are not included in their salary such as cars furniture and personal drivers. Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc.