Benefit In Kind Malaysia

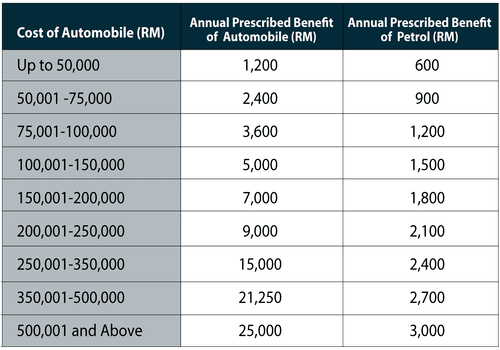

Motorcar and petrol driver gardener etc.

Benefit in kind malaysia. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc. Inland revenue board of malaysia benefits in kind public ruling no.

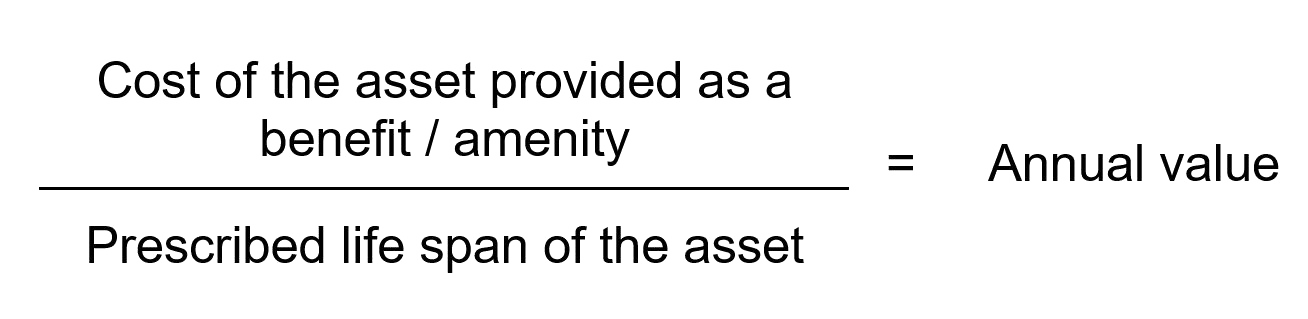

Please refer to benefits in kind below. Based on formula or prescribed value method. Objective the objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Benefits in kind public ruling no.

15 march 2013 pages 1 of 31 1. 2 2004 issued on 8 november 2004. These benefits are normally part of your taxable income except for tax exempt benefits which will not be part of your taxable income. 11 2019 date of publication.

3 2013 inland revenue board of malaysia date of issue. Several tax rules are governing how those benefits are valued for tax purposes and income tax declaration. 19 benefits in kind exemptions. Medical dental benefits.

A further clarification on benefits in kind in the form of goods and services offered at discounted prices. Inland revenue board of malaysia benefits in kind public ruling no. Certain benefits in kind pertaining to consumable services are not eligible for taxation. And one should also be awar.

3 2013 date of issue. Within malaysia not exceeding three times in any calendar year up to ya 2006 within malaysia no limit wef. Generally non cash benefits e g. Ya 2007 outside malaysia not exceeding one passage in any calendar year subject to a maximum of rm3 000.

Child care facilities benefits. These benefits are called benefits in kind bik. Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Housing accommodation unfurnished employee or service director.

12 december 2019 page 4 of 27 5 2 4 the value of bik based on the formula method provided to the employee by the employer can be abated if the bik is a provided for. And in certain cases one should also be aware of the exemptions granted. New computer broadband subscription wef. Tax exemption applies to the benefits in kind listed below unless you have control over your employer.

Benefits in kind bik include several things such as. Private treatment company car gym membership interest free loan travel expenses and living accommodation. 15 march 2013 page 1 of 28 1. There are several tax rules governing how these benefits are valued and reported for tax purposes.

Directors of controlled companies. Ya 2008 leave passages.