Benefit In Kind Motor Vehicles Malaysia 2019 Table

Motorcar means a motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers.

Benefit in kind motor vehicles malaysia 2019 table. 3 2013 inland revenue board of malaysia date of issue. And one should also be awar. Motor cars provided by employers are taxable benefit in kind. 15 march 2013 page 2 of 28 4 4.

So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit. Company car tax benefit in kind bik rates table 2019 20 to 2020 21. 3 2013 date of issue. Bik bands have currently been set until 2019 20.

Benefits in kind 2 5. Benefits in kind public ruling no. 21 21 malaysian tax booklet income tax. Presenting a consistent set of global data this.

Income tax table for 2019 2020 in malaysian ringgit myr. Table of contents 2018 2019 malaysian tax booklet 5. 11 2019 date of publication. 12 december 2019 contents page 1.

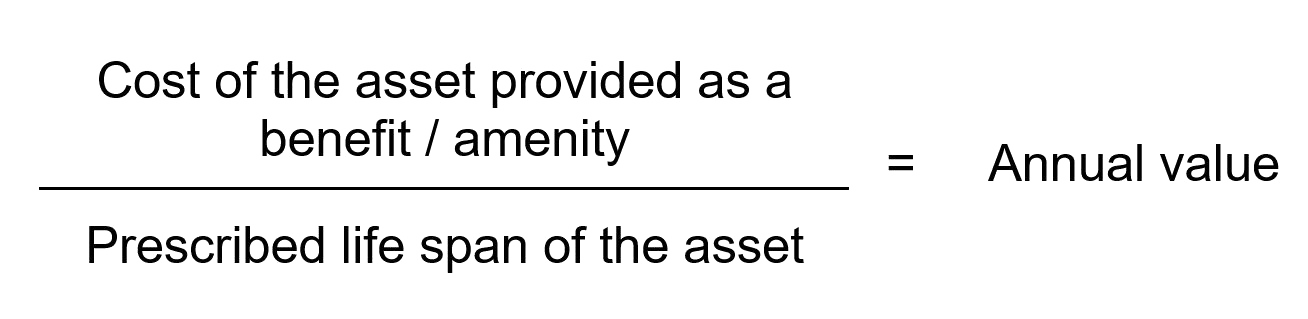

Ascertainment of the value of benefits in kind 3 6. There are several tax rules governing how these benefits are valued and reported for tax purposes. Perquisites means benefits that are convertible into money received by an. Inland revenue board of malaysia benefits in kind public ruling no.

Be aware that the diesel non rde2 supplement is now 4 and is expected to still be applicable in 2020 21. 15 march 2013 pages 3 of 31 b any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. The table below shows bik tax bands based on vehicle co2 emissions. Benefit in kind rates.

Inland revenue board of malaysia benefits in kind public ruling no. These benefits are called benefits in kind bik. Particulars of benefits in kind 4 7. Passenger motor vehicles and education.

Relevant provisions of the law 1 3. Diesel company cars incur an additional 3 benefit in kind tax supplement up to a maximum of 37. This company car tax table shows the bik rate bands based on co2 emissions. Benefit in kind on company car is calculated based on the prescribed value provided by the mirb of car cost between myr150 001 to myr200 000 where annual value of private usage of.

Generally non cash benefits e g. Accommodation or motorcars provided by employers to their employees are treated as income of the employees.

.jpg)