Islamic Banking Challenges In Malaysia

According to ram ratings malaysia was the top sukuk issuer with us 13 9 bil ringgit equivalent or 35 1 of the us 39 5 bil ringgit equivalent sukuk issued in the first quarter ended march 31 2019.

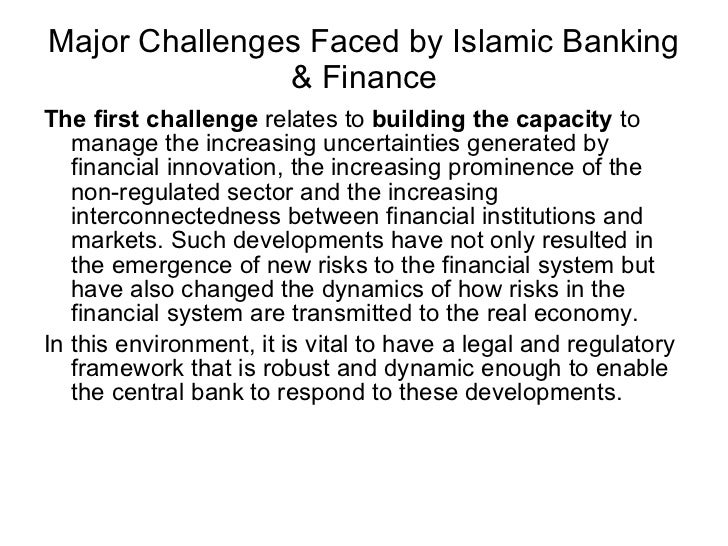

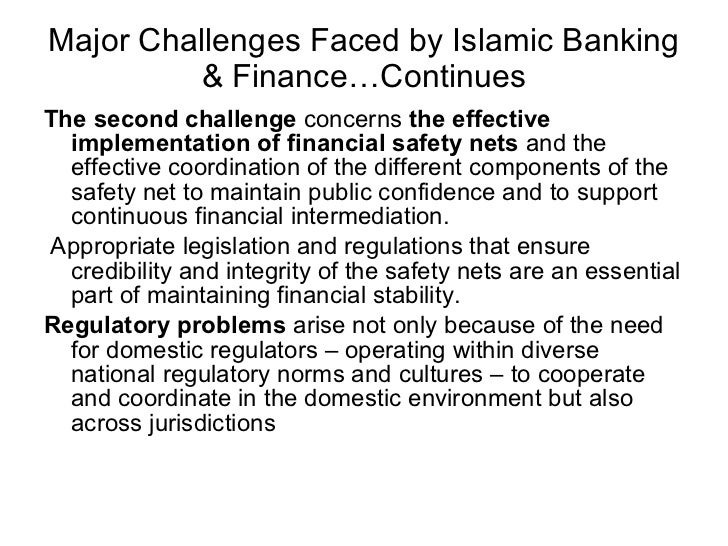

Islamic banking challenges in malaysia. It indicates 20 4 of variation in the challenges of islamic banking and financial institutions in malaysia can be explained by variation in legal challenges. With the introduction of value based intermediation vbi by bank negara malaysia bnm in 2017 the association of islamic banking and financial institutions malaysia aibim is confident the central bank s target for the local islamic banking industry to have 40 market share in total banking assets by 2020 is achievable. One study of which modes of islamic finance were used most frequently found pls financing in leading islamic banks had declined from 17 34 in 1994 6 to. Kuala lumpur sept 25.

Islamic finance has been growing rapidly in volume and diversity. In 2008 islamic banking accounted for 7 1 per cent of malaysia s financial sector. By 2016 that figure had leapt to 28 per cent and the malaysian government hopes to push it over 40 per cent by 2020. The widely held expectation that this superior growth record will continue is understandable given that approximately one sixth of the world s population is muslim most of which is based in the middle east and asia.

The islamic finance industry in malaysia is characterised by having comprehensive market components ranging from islamic banking takaful islamic money market and islamic capital market. 9 3 outpacing that of conventional banking s 3 3 underpinned by the banks. This paper evaluates the issues challenges and prospect of this emerging industry and ends with. Malaysia s a stable islamic banks financing grew by 11 in 2018 2017.

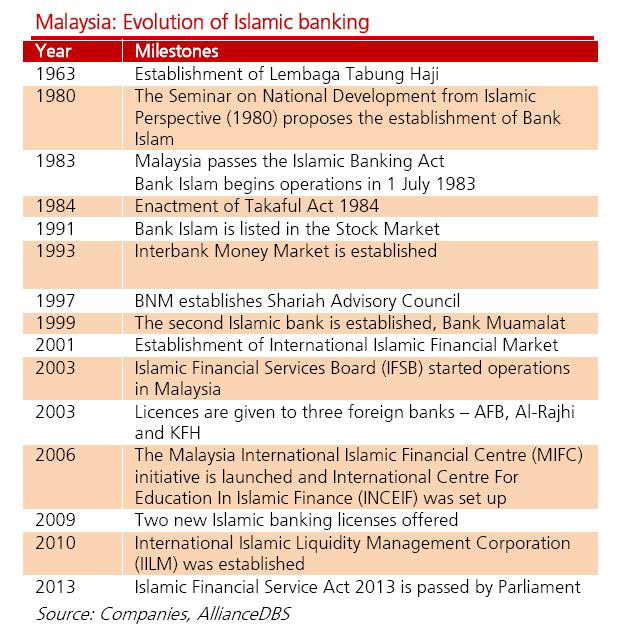

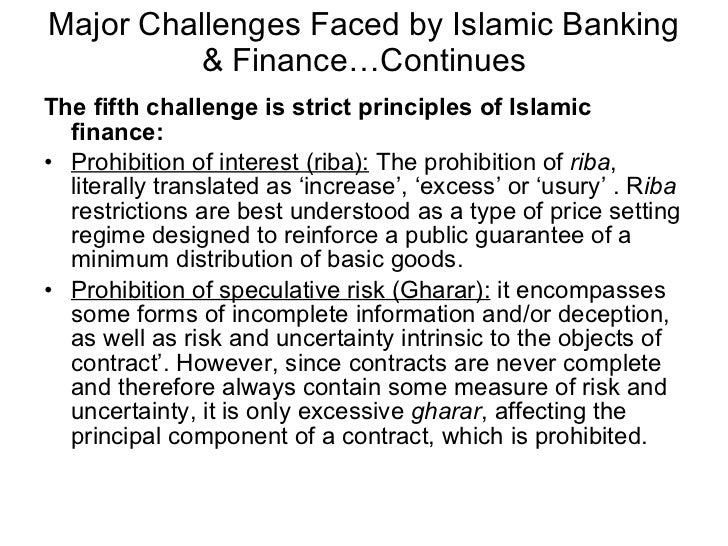

Islamic banks at least in saudi arabia and egypt have departed from using profit loss sharing techniques as a core principle of islamic banking according to a 2006 dissertation by suliman hamdan albalawi malaysia has also seen a decline. Malaysia will remain one of the top islamic finance hubs and centres of expertise education and excellence especially as this sector is so well supported at the government and central bank levels as well as through other institutions. This was followed by bank islam malaysia berhad bimb in 1983 which marked the beginning of commercial financial institutions offering islamic products and services to consumers. 4 5 interpretation of beta linear equation formula.

Institution set up to cater for the pilgrims in malaysia.