Murabahah Deposit Account Mda I

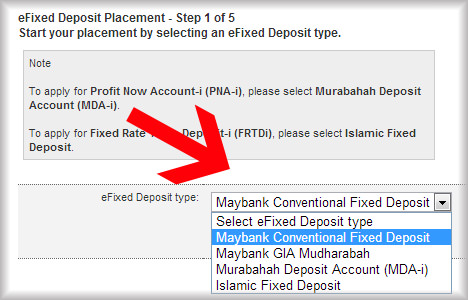

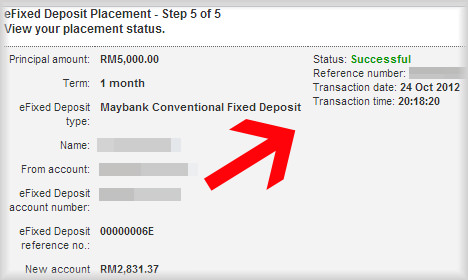

There are a few type of efixed deposit including maybank conventional fixed deposit maybank gia mudharabah murabahah deposit account mda i and islamic fixed deposit.

Murabahah deposit account mda i. Maybank conventional fixed deposit これが一般的な定期預金です islamic fixed deposit これで同じ一般的な定期預金で金利は一緒です murabahah deposit account mda i これが最長半年間の定期になります. With this account you get. Select any type of them. A to do and execute all acts with respect to the purchase of the commodity as the bank deems fit for this transaction on a cash.

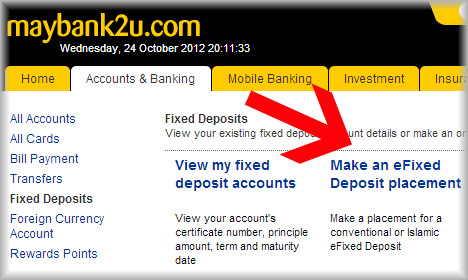

Murabahah deposit account mda i profit now account i pna i tenure. The deposit amount and. For more information on pidm click here. Next you can select efixed deposit type maybank conventional fixed deposit or maybank gia mudharabah or murabahah deposit account mda i.

Alternatively you can also consider placing your money with the same bank using a conventional banking account or a joint name account as they are insured by pidm separately. Islamic term deposits based on the shariah concept of commodity murabahah cost plus sale where a specific asset as deemed fit by the bank is identified and used as the underlying asset for the sale and purchase transaction between bank and customer. Please make sure that know the fd rates before you do the placement so you won t feel regret later. So there s 1 60 months.

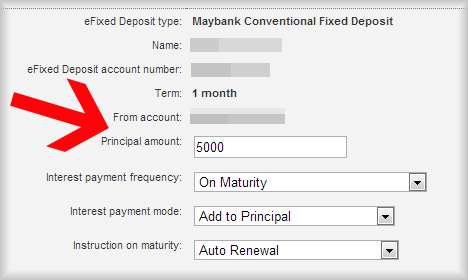

After this we select a term between 1 to 60 months. Islamic term deposits based on the shariah concept of commodity murabahah cost plus sale where a specific asset as deemed fit by the bank is identified and used as the underlying asset for the sale and purchase transaction between bank and customer. Flexibility of tenure from 1 month up to 60 months. Open to anyone aged 18 years or over prosperous now offers the easy start investment with a minimum deposit of rm10 000 and terms from one to twelve months.

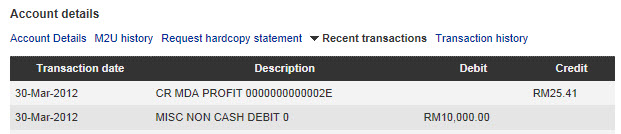

The yield return on the deposits of which the bank will credit the yield return on the deposit to the customer banking account. Upon maturity of the customer s deposit the bank will only pay the customer the deposit amount as the profit has already been paid to customer upfront. If you have more than rm250 000 you can opt to deposit in sums of rm250 000 at different banks to protect your money. After that please select term of your efd.

Rm10 000 with increments in multiples of rm1 000 islamic fixed deposit fixed rate term deposit i frtdi note. 1 6 months minimum investment.