Musharakah Mutanaqisah Home Financing In Malaysia

As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks.

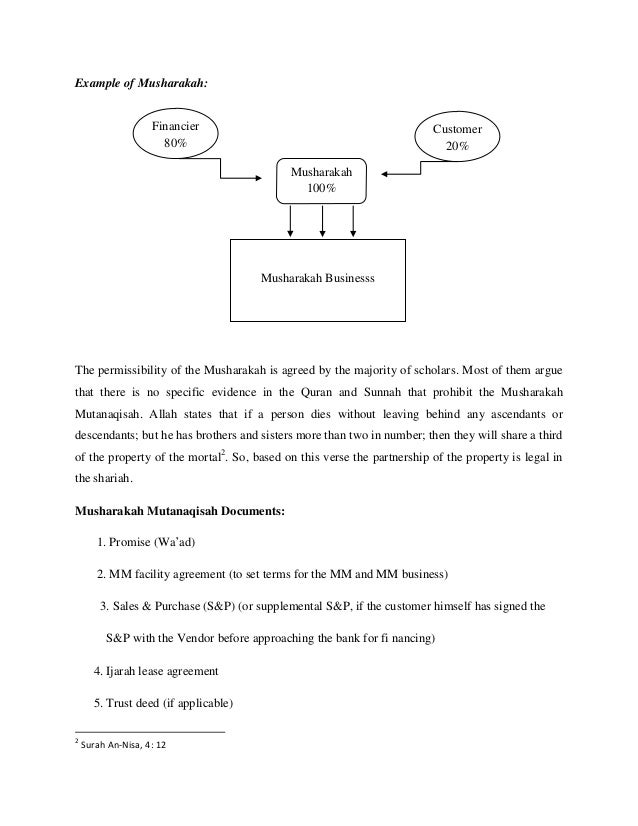

Musharakah mutanaqisah home financing in malaysia. It is not that it is impossible. As an alternative to bba contract kuwait finance house malaysia berhad kfhmb launched malaysia s first equity based house financing facility under the musharakah mutanaqisah concept in 2006 which is considered to be more shariah compliant compared to bba meera and abdul razak 2005 that has been practiced in malaysia from the beginning and always been under the criticism for its inah. Shariah advisory council bank negara malaysia there was a proposal from an islamic financial institution to offer islamic house financing product based on the concept of musyarakah mutanaqisah. A simulation case study approach since 1990s the increase in housing price housing loan application rejection and bankruptcy due to housing loan default have highlighted the need for a better way of home financing.

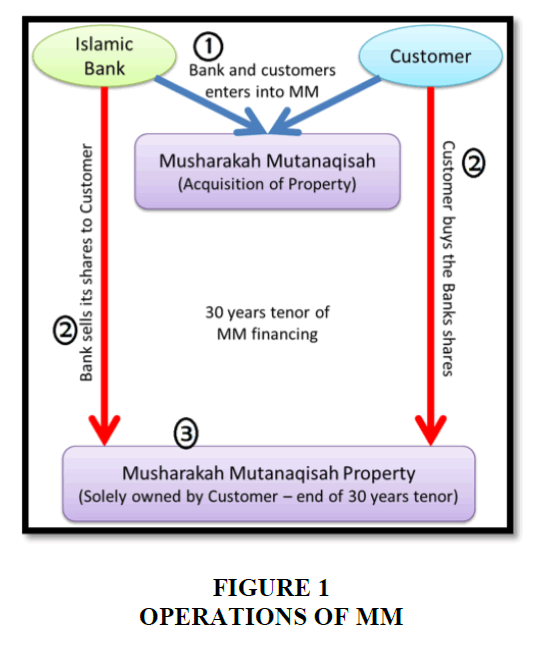

Home loans in malaysia faq. Essentially islamic banks follow two types of islamic banking principles bai bithaman ajil bba and musharakah mutanaqisah mm. Buying a house is probably the most important purchase you ll ever make. Musharakah mutanaqisah is an alternative contract that can be offered under home financing and can replace bai bithaman ajil bba as bba is similar to fixed rate debt financing or murabahah.

Musharakah mutanaqisah mm home financing for affordability of homeownership. This study aims to identify the challenges surrounding the implementation of musharakah mutanaqisah islamic home financing in malaysia. Challenges in implementing musharakah mutanaqisah islamic home financing in malaysia fahad qureshi1 and sutan emir hidayat2 1 certified islamic finance professional department inceif kuala lumpur malaysia 2department of business administration and humanities university college of bahrain manama kingdom of bahrain. Musharakah mutanaqisah home financing in malaysia.

For more information on the difference between islamic and conventional financing see types of home loans in malaysia. One of the key reasons there are still a number of unresolved issues if these banks were to strictly follow the rules of musharakah mutanaqisah contract. Despite it is more shariah compliant than other products such as bay bithaman ajil home financing musharakah mutanaqisah home financing is still not in favor of the islamic banks in malaysia when they structure their mortgages. But to implement it.

Your home loan is likely to be not only your biggest household expense but the largest financial.