Public Mutual Prs Equity Fund Performance

Compare this value with the 12 16 of cimb principal prs plus asia pacific ex japan equity.

Public mutual prs equity fund performance. The funds under the private retirement scheme prs had a good 2017 with rising assets under management aum and a rapidly growing membership base. Give us a call at 603 2022 5000. 0 04 per annum of nav subject to a maximum fee of rm300 000 per annum. On average the funds performed commendably.

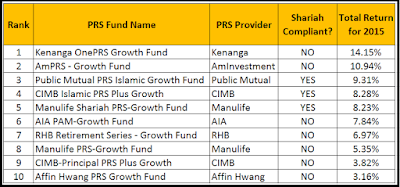

Performance charts for public mutual prs conservative fund pmprscv including intraday historical and comparison charts technical analysis and trend lines. Top 5 performing funds for short term investment 1 5 years if you re investing for short term gain typically within 3 months to 5 years you must make sure that the fund you re investing can give a higher return than fixed deposit rate which averages around 3. The public mutual fund with the highest earnings is public mutual prs equity fund. Public mutual prs strategic equity non core 03 09 2015 3 00 1 60 35 35 6 58 6 18 9 96 13 12 4 20 public mutual prs islamic conservative core conservative shariah 26 11 2012 3 00 1 00 32 08 3 74 5 64 7 22 15 08 4 79 24 13 4 42 30 92 3 92.

Public mutual prs strategic equity fund is an open end pension fund incorporated in malaysia. Annual scheme trustee fee. Public mutual prs islamic growth moderate strategic equity fund. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

Its 1 year returns ending 14 june 2018 is 8 02. The fund aims to achieve long term capital growth. Our products unit trust. Public mutual prs growth moderate equity strategic equity fund.

Furthermore the returns of public mutual prs equity fund will decrease when we take into consideration of the 3 sales. Public mutual prs conservative islamic conservative fund. The asset management companies attributed their performance to factors such as a recovery in global trade an improvement in corporate earnings and soaring stock markets the world over.