Shariah Non Compliance Risk Example

Romzie rosman isra march 2016 disclaimer.

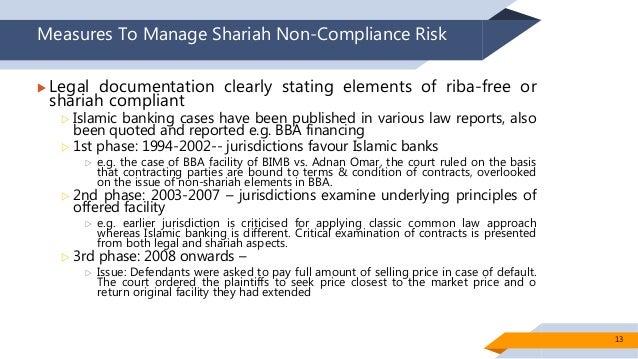

Shariah non compliance risk example. Once a product or transaction is flagged as potentially shariah non compliant in a shariah audit it is referred to the bank s shariah board to determine if the transaction is batil or fasid. Impact on capital adequacy framework of islamic banks erdem oz ifsb zahid ur rehman khokher ifsb mohammad mahbubi ali isra dr. Ifsb working paper series wp 05 03 2016 sharīʻah non compliance risk in the banking sector. Sidc cpe accredited.

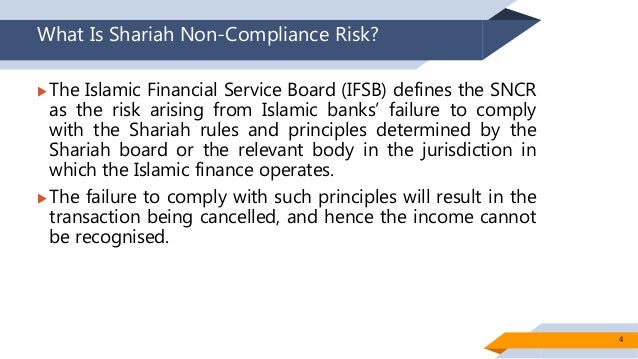

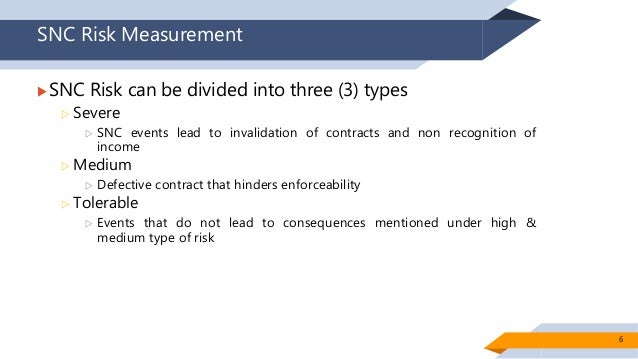

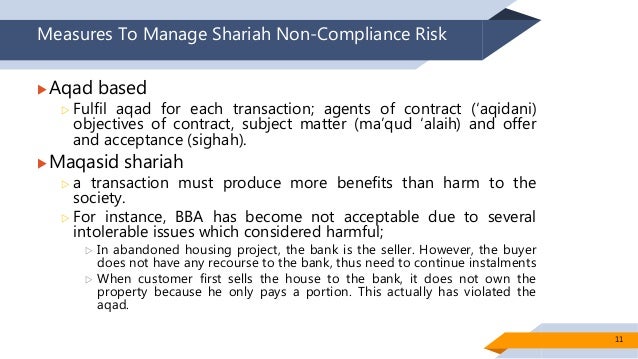

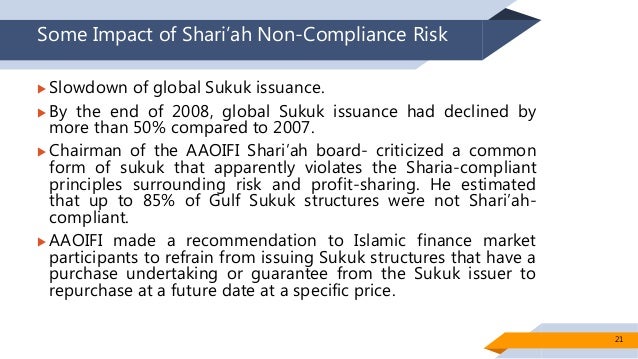

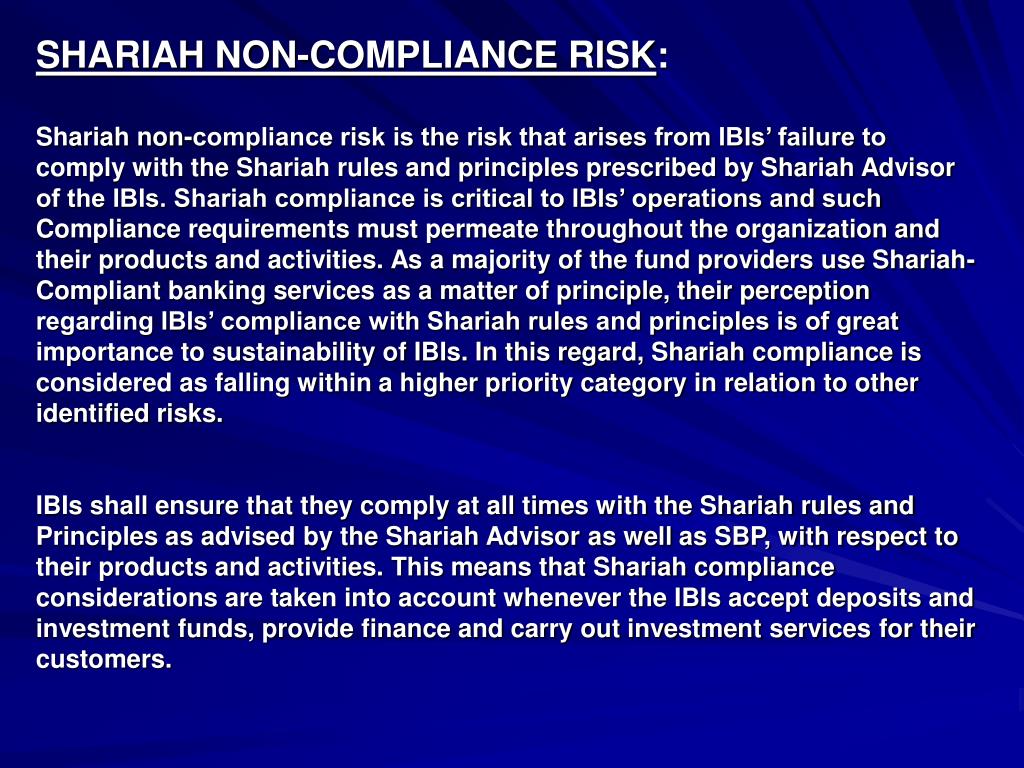

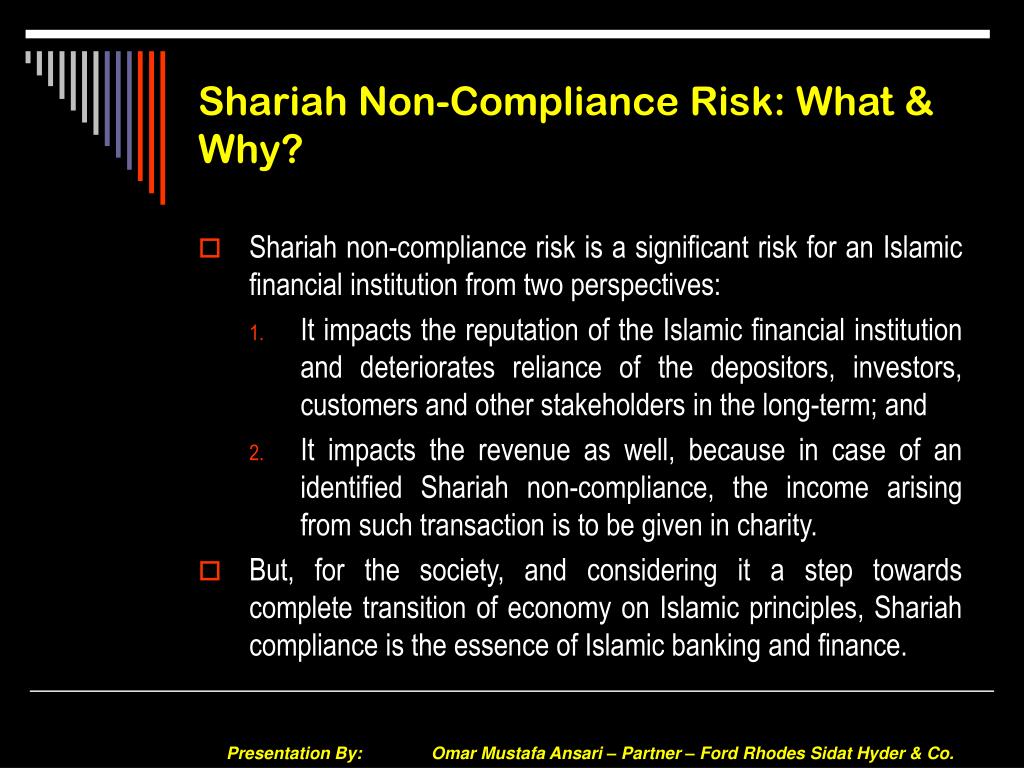

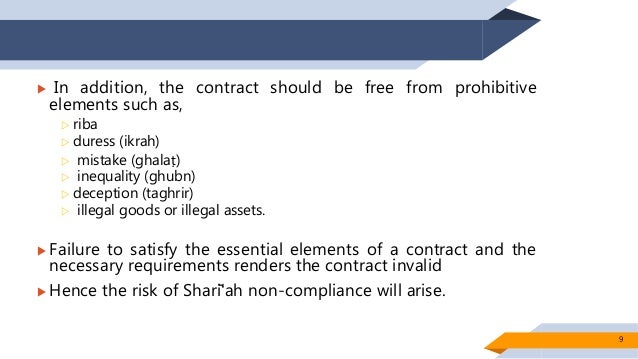

Shariah non compliance risk has been defined as the risk that arises from the bank s failure to comply with the shariah rules and principles determined by the relevant shariah regulatory councils islamic financial services board ifsb. Shariah risk ratings non comply totally contravene with shariah principles or the s s rulings or sa decisions or does not have shariah unit s sign off or approval. Shariah risks are a growing concern since the direct consequence of the non compliance with shariah is a decline in the profits as any profits related to a tainted and non shariah compliant transaction is haram forbidden and therefore the profits cannot be accounted as profits or distributed as dividends. The establishment of these control functions and the strengthening of their capacity over time have been instrumental in promoting a strong shariah compliance risk culture within islamic fi nancial institutions.

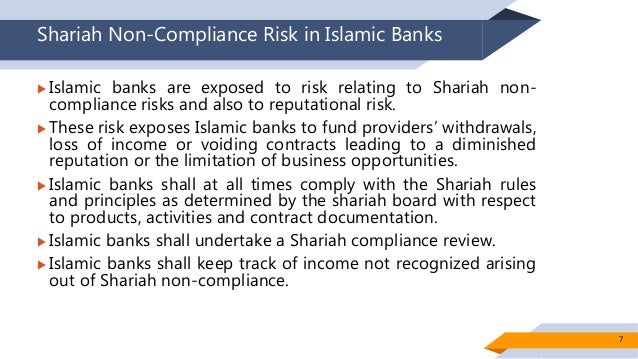

Implications of each of the above for shariah audit risk management and shariah non compliance reporting functions within an islamic financial institution revisions to the shariah governance framework and disclosure requirements in 2017 from an audit compliance and non compliance reporting perspective. Comply comply when it clearly attains the shariah approval and its official sign. This working paper should not be reported as representing the views of the islamic financial services board ifsb. Shariah non compliance risk in islamic banks islamic banks are exposed to risk relating to shariah non compliance risks and also to reputational risk.

Iifs shall have in place appropriate strategies risk management and reporting process in respect of the risk. Islamic banks shall at all times comply with the shariah. Shariah compliant investment products and entities have an inherent shariah risk. An islamic fi nancial institution s compliance with shariah and management of shariah non compliance risks.

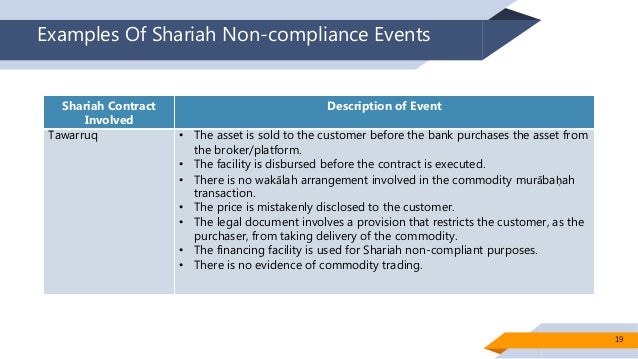

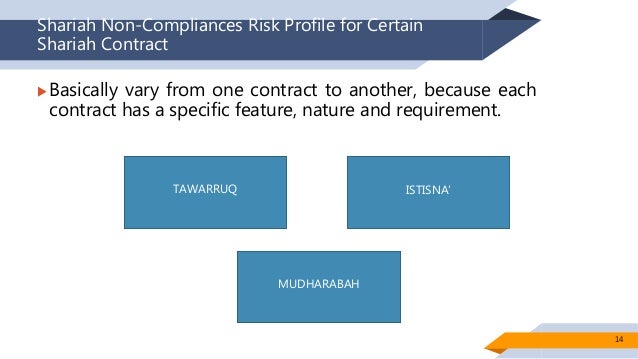

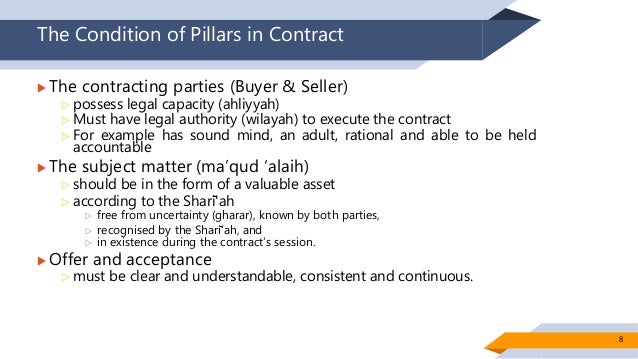

The shariah compliance of a product is determined primarily by looking at the shariah compliant status of its underlying contract. Non compliant process non compliant product defect in documentation the end by awangku muhamad fauzi 01dib13f2036 characteristics speed with complete principle 3 1.