Shariah Non Compliance Risk In Islamic Banking

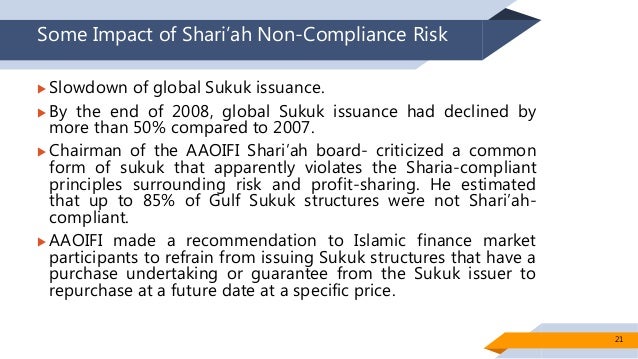

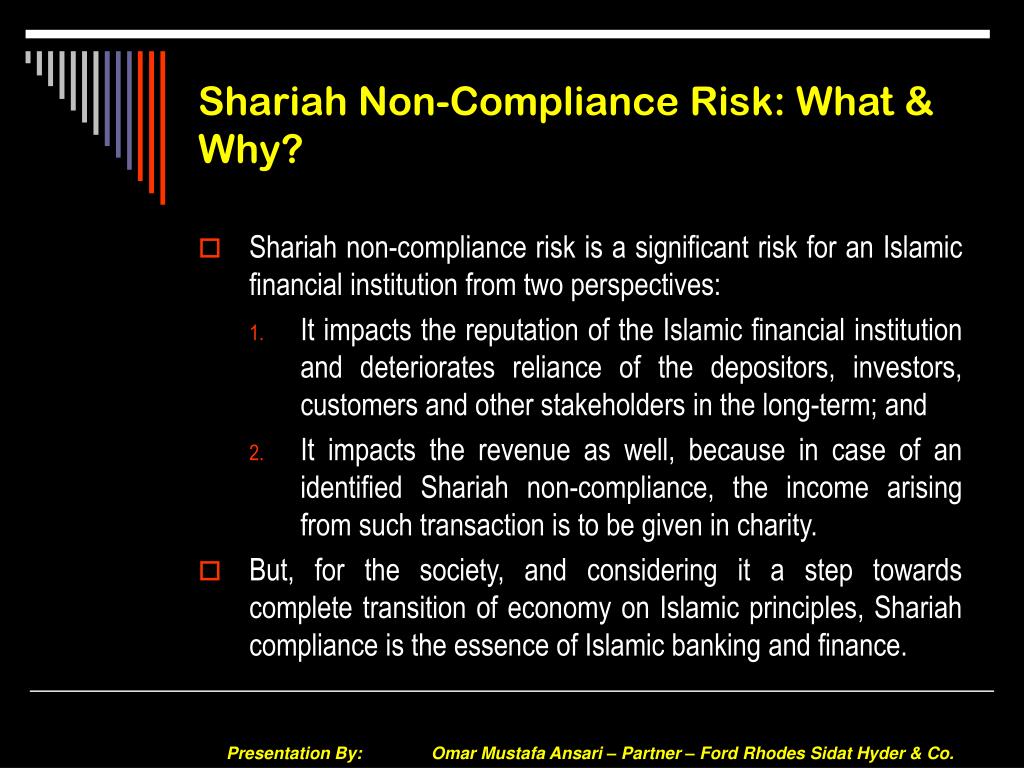

Inadequate attention to the whole process of shariah compliant aspect will trigger negative repercussion to ifis such as massive withdrawal and financial loss.

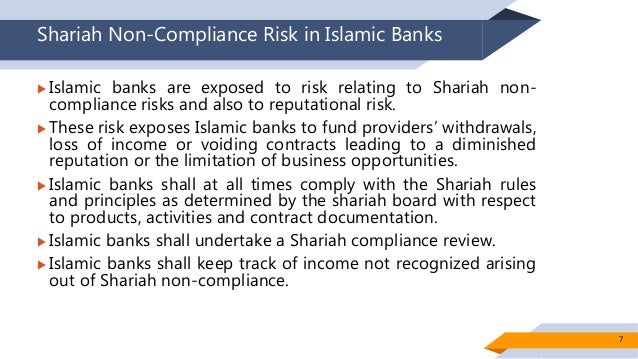

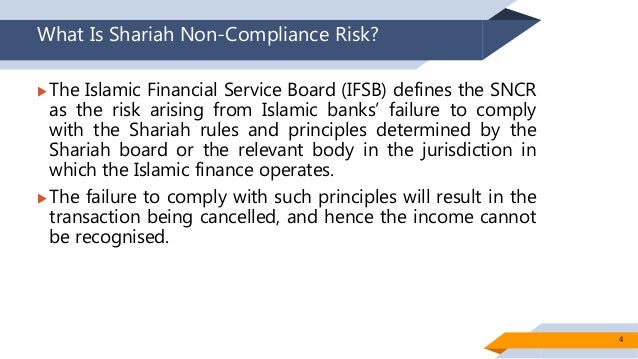

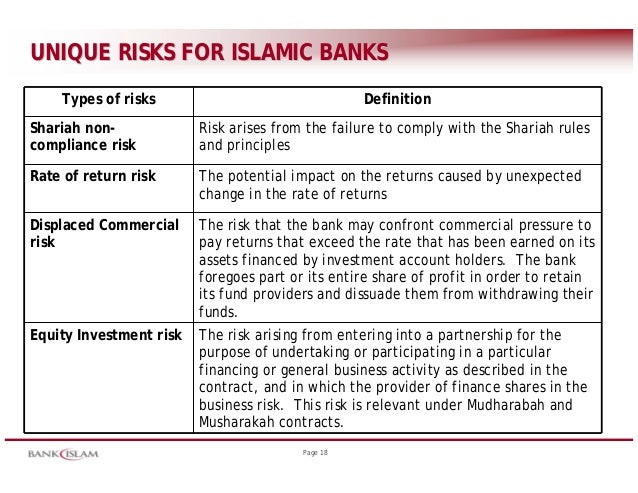

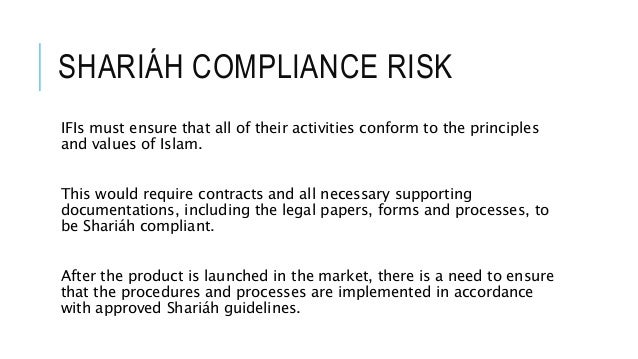

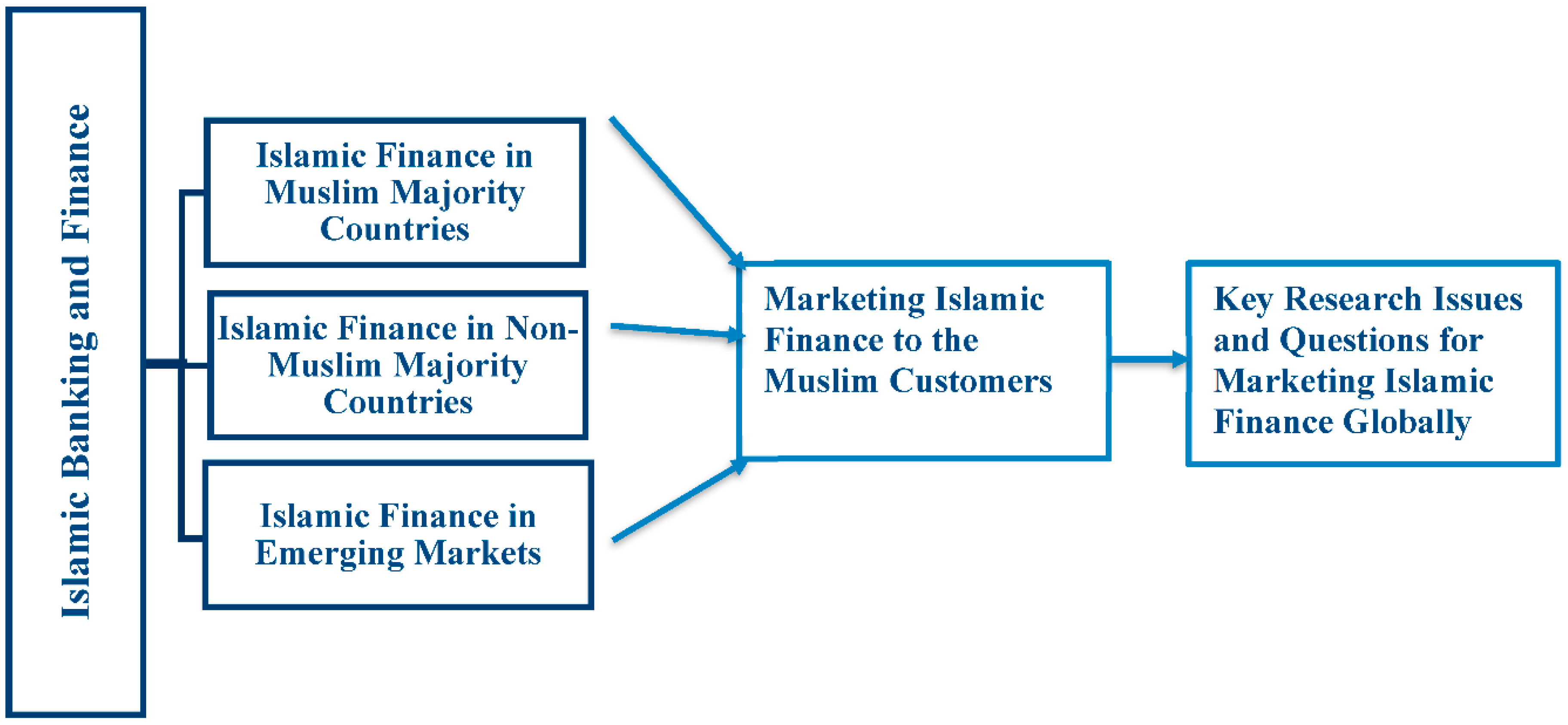

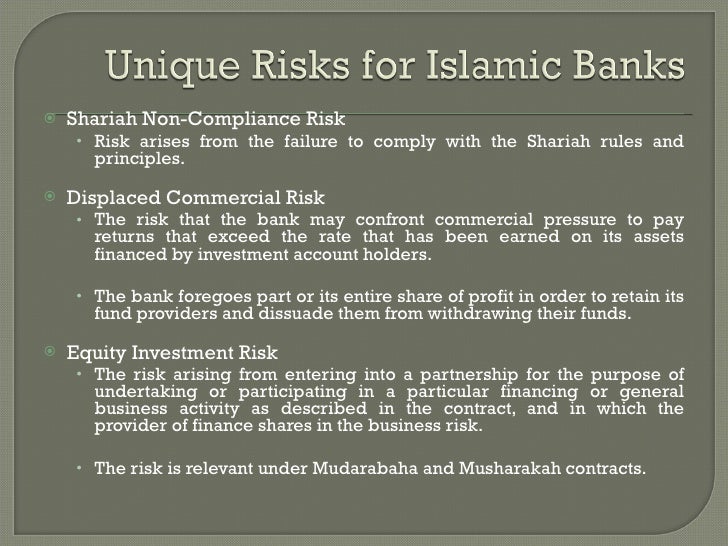

Shariah non compliance risk in islamic banking. Other factors that influence the growth of islamic banking institutions are interest free or riba free finance strong demand for shariah compliance legal and regulatory framework improvement and capacity of the. The concept of non compliance and the onus it creates has recently become more significant by being explicitly tied to important islamic banking legislation such as islamic financial services act 2013. Ensuring shari ah compliant aspect is imperative for islamic financial institutions ifis to main tain the confidence level of stakeholders and public at large. Ifsb working paper series wp 05 03 2016 sharīʻah non compliance risk in the banking sector.

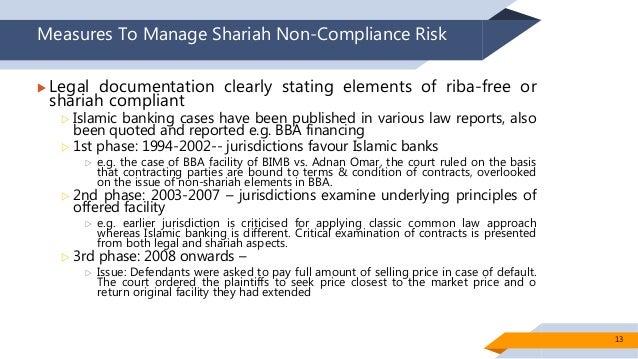

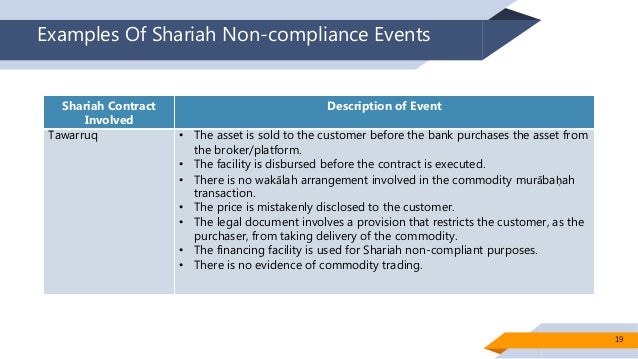

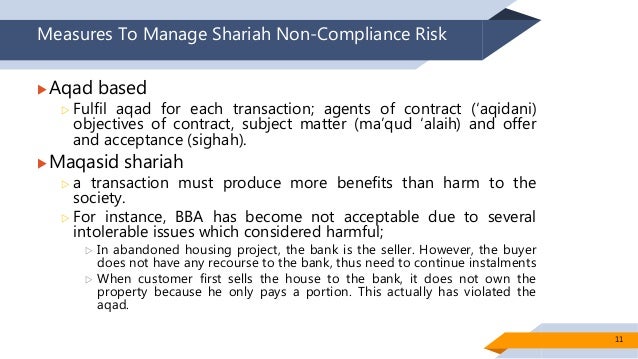

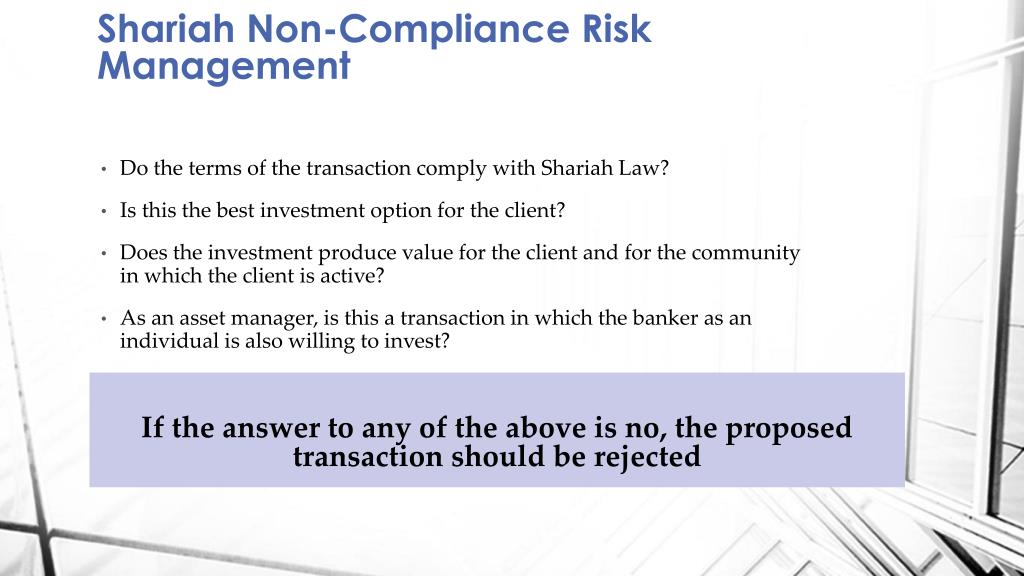

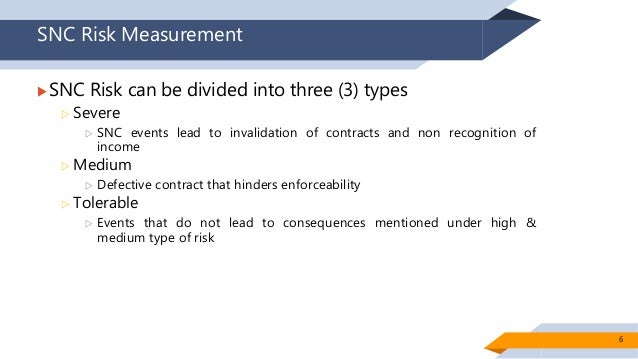

Bba financing 1st phase. Measures to manage shariah non compliance risk legal documentation clearly stating elements of riba free or shariah compliant islamic banking cases have been published in various law reports also been quoted and reported e g. In islamic banking these positions can only be achieved by strengthening the shariah governance practice. The new risk is the shariah non compliance risk sncr which potentially can hamper the bank s ability to meet capital adequacy ratio car requirements.

Adnan omar the court ruled on the basis that. In view of the rivalry with the conventional banking sector islamic banks offer new innovative islamic products and financial projects which may lead to greater risk of shariah non compliance. The case of bba facility of bimb vs. Ahmad arif bin mohd arshad has been head of shariah compliance of rhb bank berhad rhbb in kuala lumpur since 2014 prior to assuming his new role as head of group shariah business compliance of rhbb in jan 2016.

Impact on capital adequacy framework of islamic banks erdem oz ifsb zahid ur rehman khokher ifsb mohammad mahbubi ali isra dr. 1994 2002 jurisdictions favour islamic banks e g. Head group shariah business compliance group risk compliance credit management rhb islamic. Islamic banking products however have also brought to the fore a new type of risk that the regulators and the banks themselves have to manage.

Islamic banks journal of banking finance volume 58 september 2015 pages 418 435 sabur mollah mahbub zaman. This working paper should not be reported as representing the views of the islamic financial services board ifsb. Snc risk is considered as the unique risk of islamic banks and ifis compared to the conventional counterparts. Romzie rosman isra march 2016 disclaimer.