Shariah Non Compliance Risk Pdf

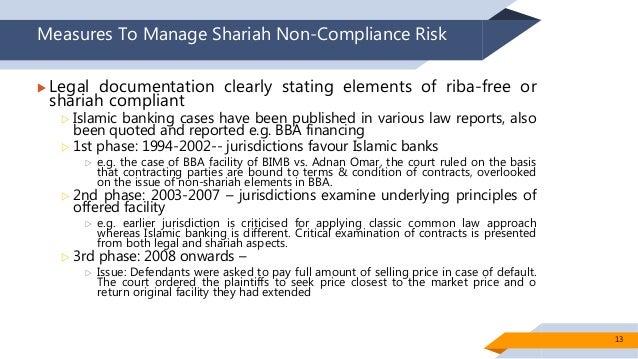

An example of shariah non compliance risk could also include unenforceability of shariah.

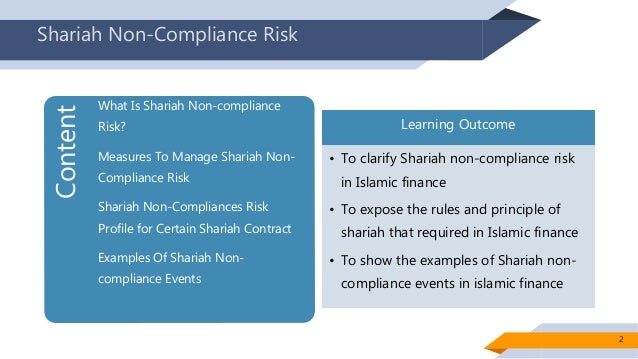

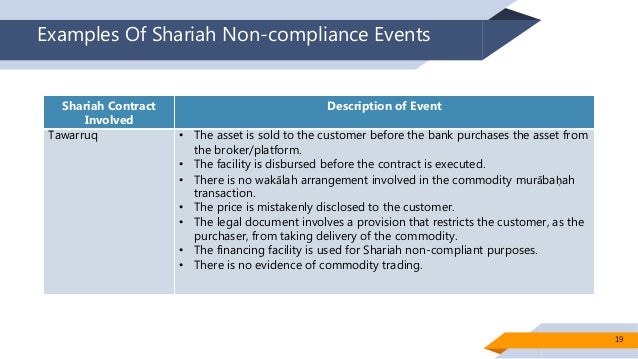

Shariah non compliance risk pdf. The shariah compliance of a product is determined primarily by looking at the shariah compliant status of its underlying contract. This study aims to investigate the relationship between corporate governance and shariah non compliant risk sncr that is unique for islamic banks. The course is designed to provide the participants with a comprehensive and practical un derstanding on managing shariah non compliant risk in ifis. Comply comply when it clearly attains the shariah approval and its official sign.

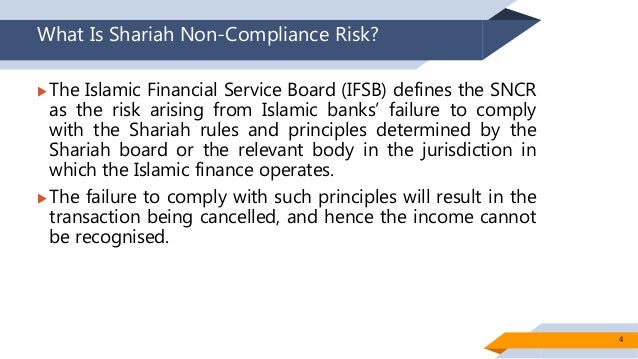

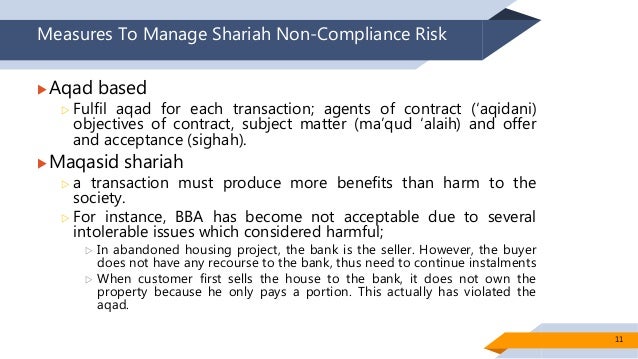

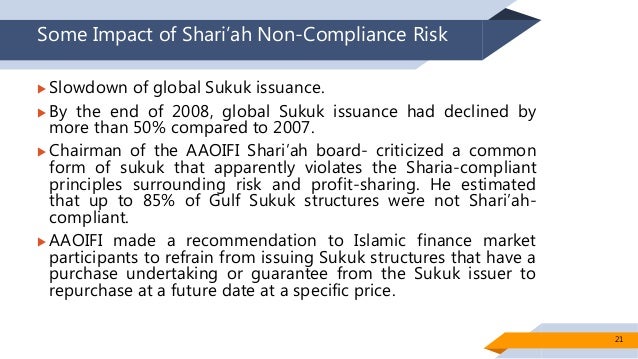

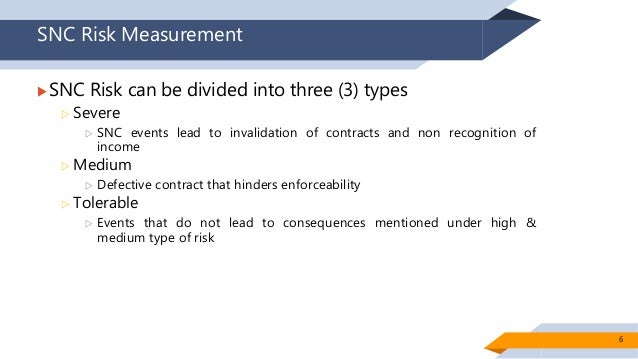

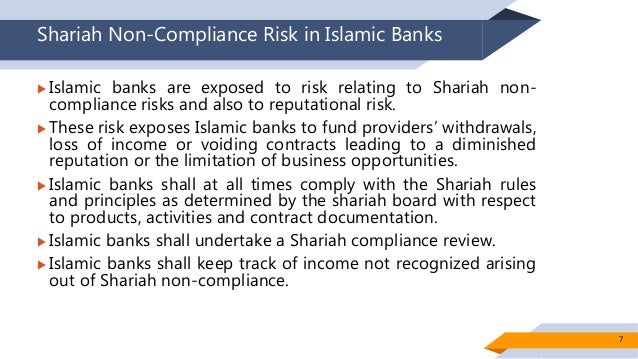

Shariah non compliance risk in insurance system is a failure to comply with shariah law in performing the insurance business activities and operations. Actual shariah non compliance risk restricted 11. Shariah non compliance risk shari ah non compliance risk is the risk that rises from ibis failure to comply with the shari ah principles prearranged by state bank of pakistan and shari ah advisor of the ibis ibd 2008. Shari ah non compliance risk sncr arises from the negligence or failure to.

This article highlights the approach by the bank and the practices of. Understand the significance of shariah compliance and shariah governance in ifis understand the key shariah non compliant risk areas in ifis understand the process of shariah non compliant event reporting apply the rectification plan for shariah non compliant events. Request pdf shariah non compliance risk and its effects on islamic financial institutions the objective of this paper is to provide the definition of shariah non compliance risk associated. Shariah risk ratings non comply totally contravene with shariah principles or the s s rulings or sa decisions or does not have shariah unit s sign off or approval.

Shariah non compliance risk can also result in legal risk being the failure to comply with contractual obligations and compliance risk which is the risk of non compliance with laws and regulations ginena and hamid2015. Hence understanding shariah non compliant risk management is essential to ensure shariah compliant aspect in place. Once a product or transaction is flagged as potentially shariah non compliant in a shariah audit it is referred to the bank s shariah board to determine if the transaction is batil or fasid.