Shariah Non Compliance Risk

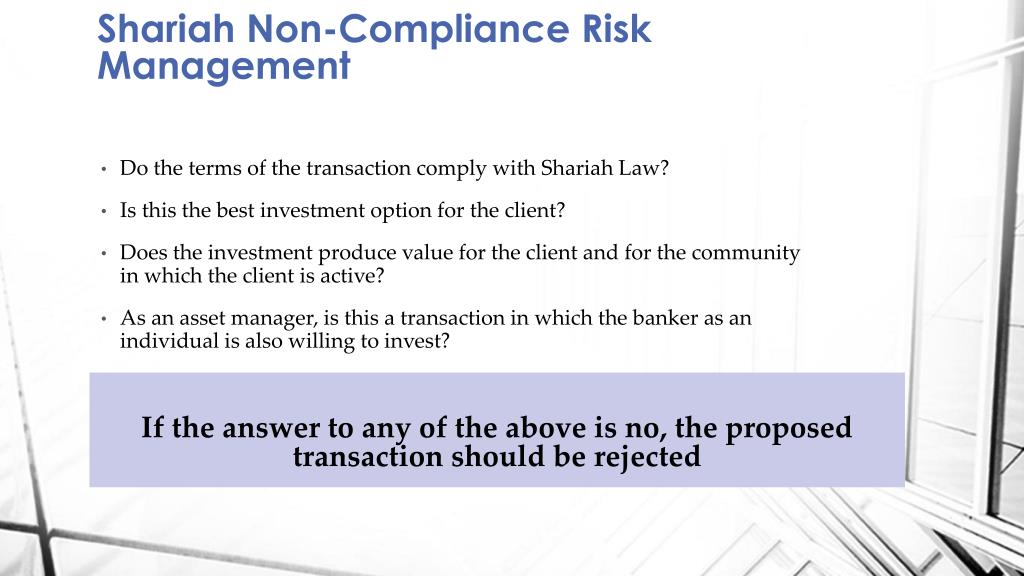

Once a product or transaction is flagged as potentially shariah non compliant in a shariah audit it is referred to the bank s shariah board to determine if the transaction is batil or fasid.

Shariah non compliance risk. This two hour course is designed to provide the participants with a practical understanding of managing shariah non compliant risk in islamic financial institutions ifis. Romzie rosman isra march 2016 disclaimer. Shariah non compliance snc risk is the risk that arises from the group s failure to comply with the shariah rulings as determined by sac of bnm and sc board shariah committee and the relevant shariah regulatory authorities of the jurisdictions in which the group operates snc risk may lead to financial and non financial impact to the group such as reputation risk higher capital charges. Shariah non compliance risk refers to the risk of legal or regulatory sanctions financial loss or non financial implications including reputational damage which an ifi may suffer arising from failure to comply with the rulings of the shariah advisory council of bank negara malaysia sac standards on.

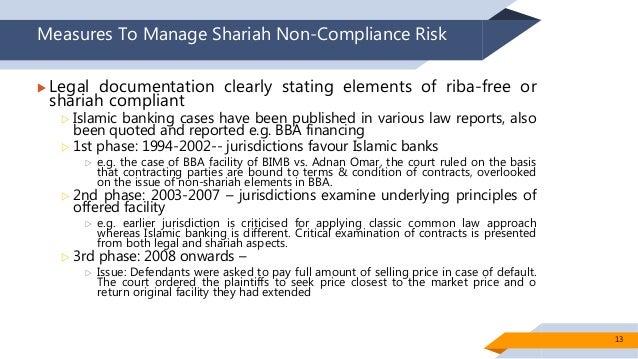

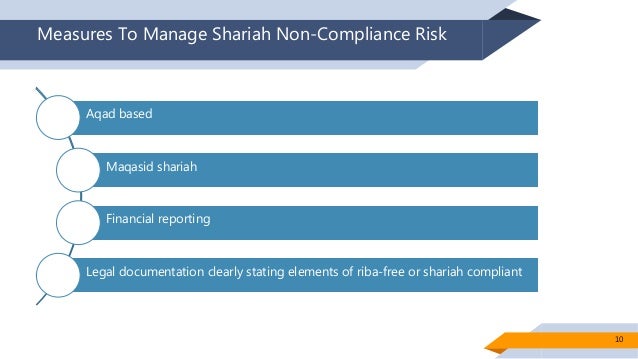

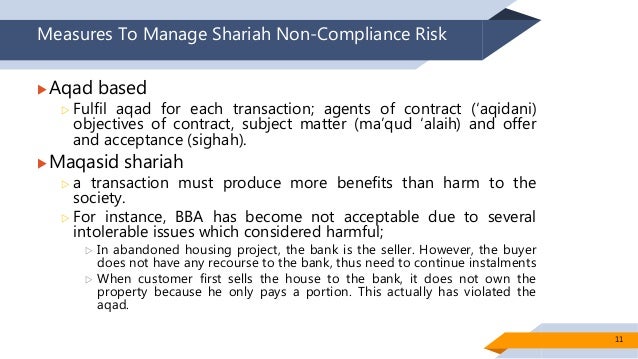

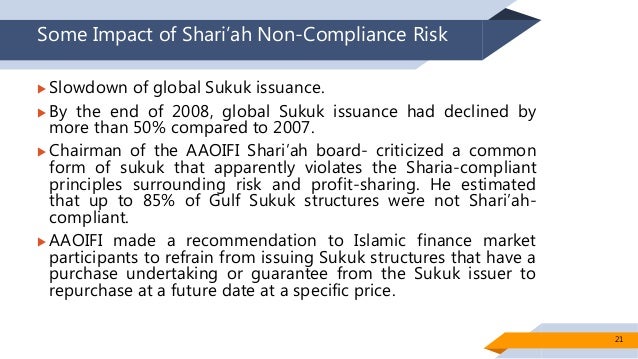

These risk exposes islamic banks to fund providers withdrawals loss of income or voiding contracts leading to a diminished reputation or the limitation of business opportunities. The effective management of shariah non compliance risk is therefore paramount especially with the growing signifi cance of islamic fi nance as a key component of the fi nancial system domestically and globally. Islamic banks shall at all times comply with the shariah. The shariah compliance of a product is determined primarily by looking at the shariah compliant status of its underlying contract.

Shariah non compliance risk has been defined as the risk that arises from the bank s failure to comply with the shariah rules and principles determined by the relevant shariah regulatory councils islamic financial services board ifsb by offering islamic banking. Comply comply when it clearly attains the shariah approval and its official sign. Shariah compliant investment products and entities have an inherent shariah risk. Impact on capital adequacy framework of islamic banks erdem oz ifsb zahid ur rehman khokher ifsb mohammad mahbubi ali isra dr.

This working paper should not be reported as representing the views of the islamic financial services board ifsb. Any income derived from shariah non compliant incidents cannot be recognized as ifi profit. Shariah risks are a growing concern since the direct consequence of the non compliance with shariah is a decline in the profits as any profits related to a tainted and non shariah compliant transaction is haram forbidden and therefore the profits cannot be accounted as profits or distributed as dividends. This article highlights the approach by the bank and the practices of.

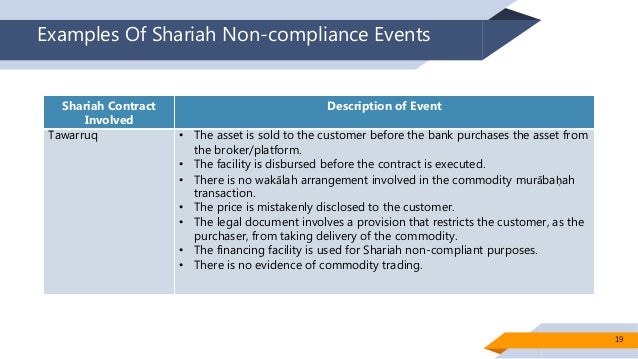

Actual shariah non compliance risk restricted 11. Shariah non compliance risk in islamic banks islamic banks are exposed to risk relating to shariah non compliance risks and also to reputational risk.