Redeemable Preference Shares Malaysia

Goldis berhad can purchase buy back the preference shares from and including the 4th anniversary of the issue date up to the maturity of the 7 year period.

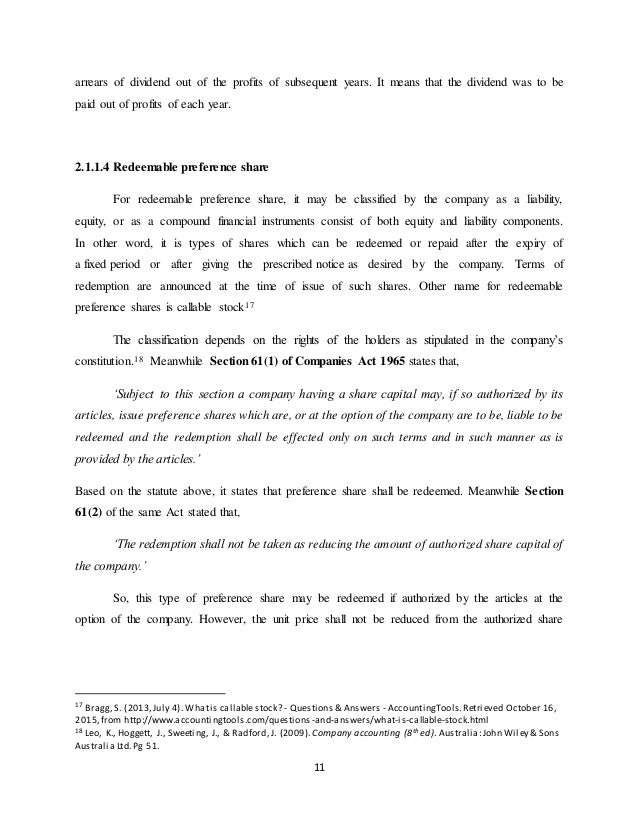

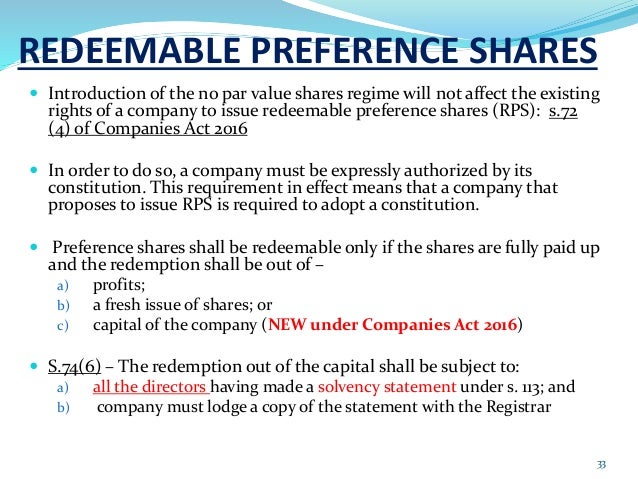

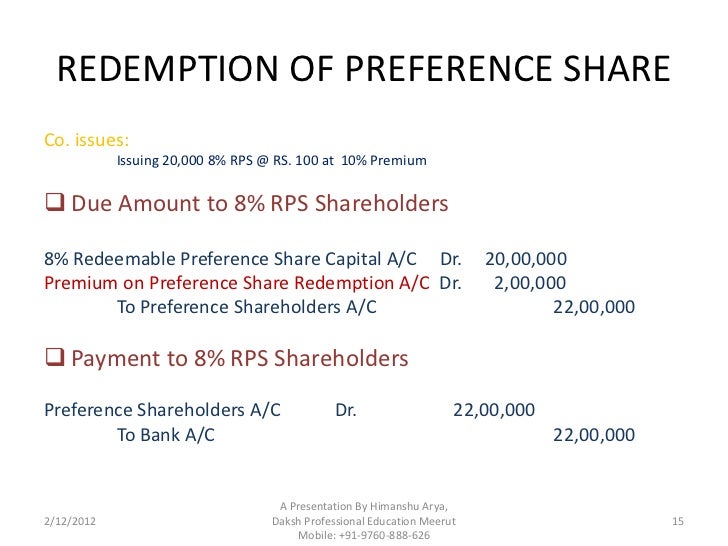

Redeemable preference shares malaysia. Lodgement of court order to confirm or disallow variation of class rights. Pursuant to section 72 5 where preference shares are redeemed out of profits or capital of the company the company would be required to transfer out of profits an equivalent amount into the share capital of the company. This requirement in effect means that a company that proposes to issue rps is required to adopt a constitution. Redeemable preference shares aka convertible preference shares.

Bar council malaysia proposes for safety precautions against fire incidents. Notice of approval for allotment of shares or grant of rights. Redeemable preference shares rps are a type of preference shares that are issued on terms that they may be redeemed in the future at the company s option or subject to the terms of issue. 1 subject to this section a company having a share capital may if so authorized by its articles issue preference shares which are or at the option of the company are to be liable to be redeemed and the redemption shall be effected only on such terms and in such manner as is provided by the articles.

Notice of redemption of preference shares. Ii on each dividend date as defined below thereafter preferences shares. 15 07 2005 22 02 2020 administrator company law. B a fresh issue of shares.

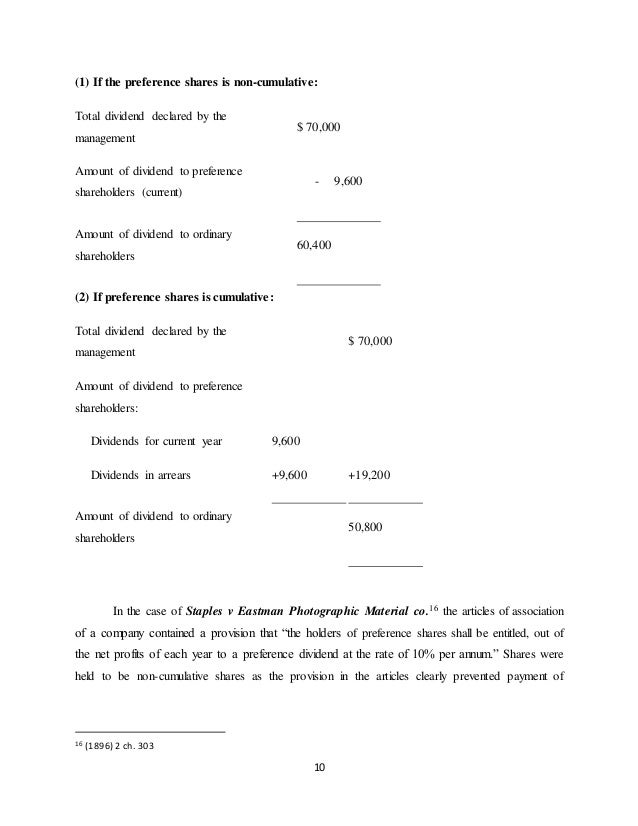

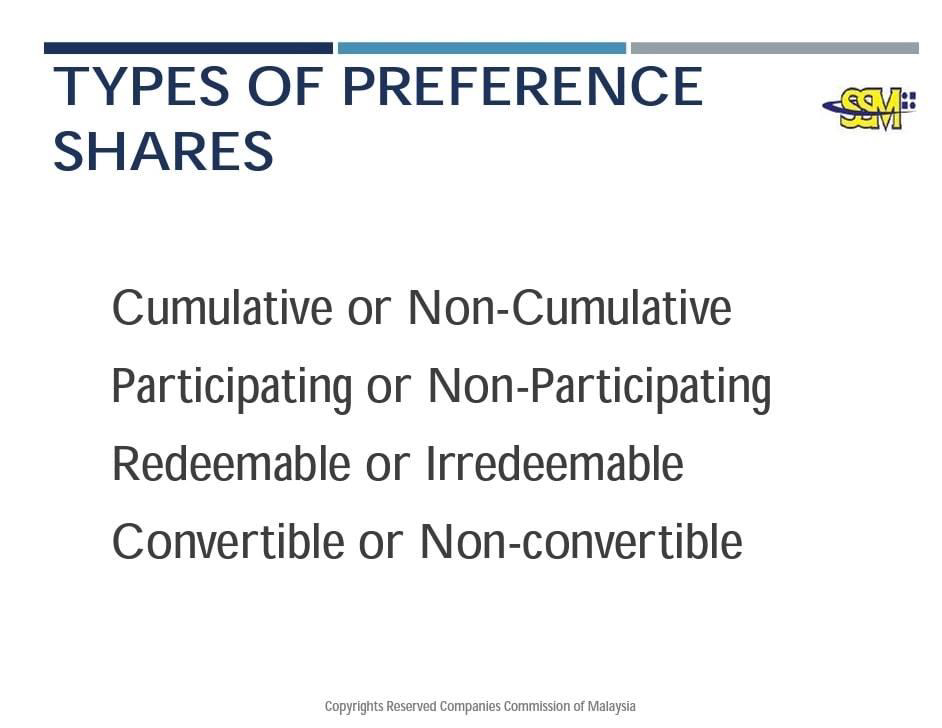

Preference shares shall be redeemable only if the shares are fully paid up and the redemption shall be out of a profits. Preference shares non cumulative non convertible preference shares qualifying as tier 1 capital of ocbc malaysia redeemable at the option of ocbc malaysia i ten years after the issuance thereof. Pdf word updated as at 13 01 2020 24. Preference shares represent an ownership stake in a company.

It is considered to a hybrid of debt and equity depending on its exact terms and can be issued for short term access to capital from investors. Under the ca preference shares are redeemable out of profits a fresh issue of shares or capital of the company. 1 preference share can be converted to 1 ordinary share at any time during the 7 year period. Under the ca preference shares are redeemable out of profits a fresh issue of shares or capital of the company.

Notification of alteration of share capital. Redeemable preference shares aka convertible preference shares.