Shariah Non Compliance Risk Meaning

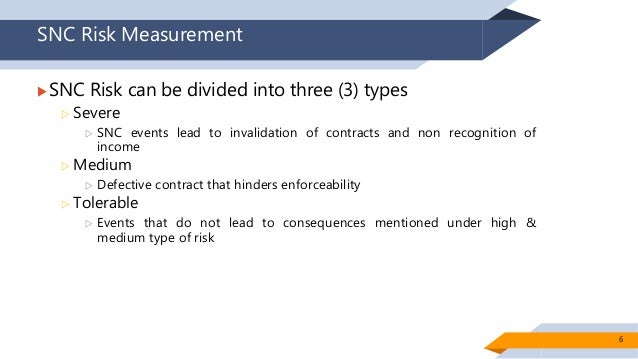

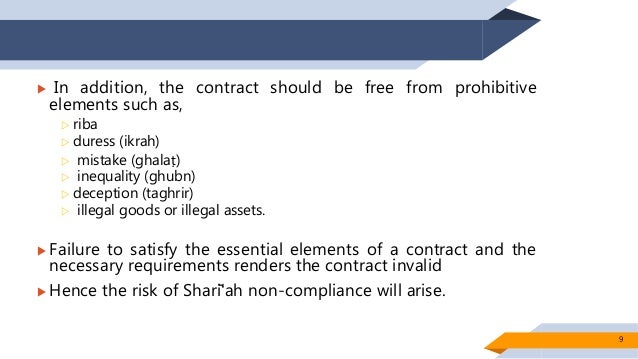

These standards define operational risk as the risk of loss resulting from inadequate or failed internal processes people and systems or from external events which includes but is not limited to legal risk and sharīʻah non compliance risk the types of risk are explained in detail in the following subsections.

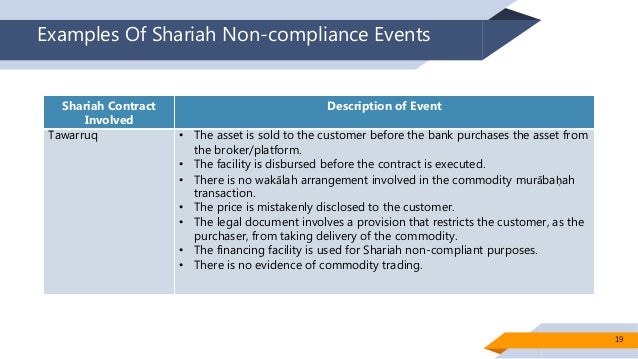

Shariah non compliance risk meaning. Shariah non compliance snc risk is the risk that arises from the group s failure to comply with the shariah rulings as determined by sac of bnm and sc board shariah committee and the relevant shariah regulatory authorities of the jurisdictions in which the group operates snc risk may lead to financial and non financial impact to the group such as reputation risk higher capital charges. Comply comply when it clearly attains the shariah approval and its official sign off and any subsequent issues also comply with the shariah principles. Once a product or transaction is flagged as potentially shariah non compliant in a shariah audit it is referred to the bank s shariah board to determine if the transaction is batil or fasid. Username or email address.

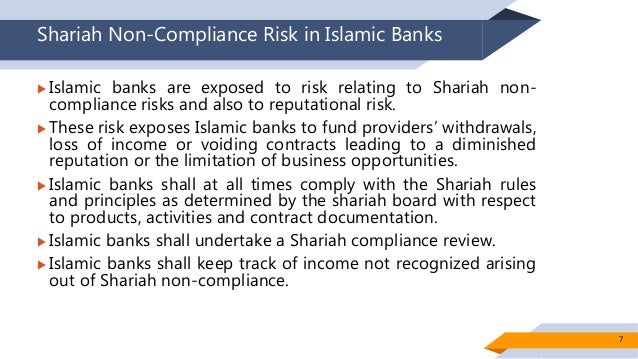

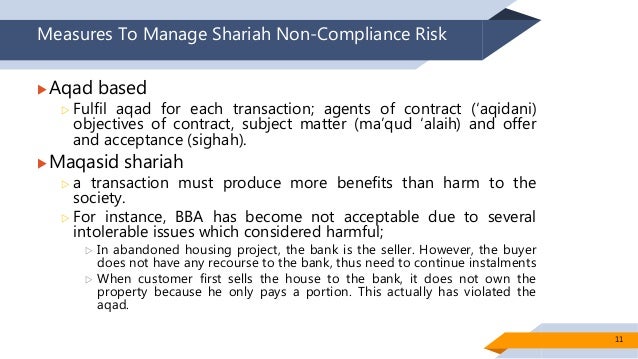

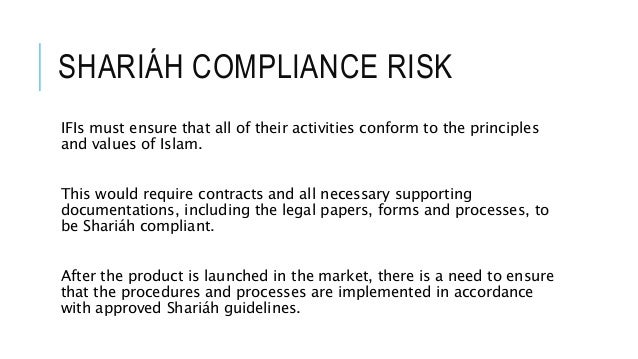

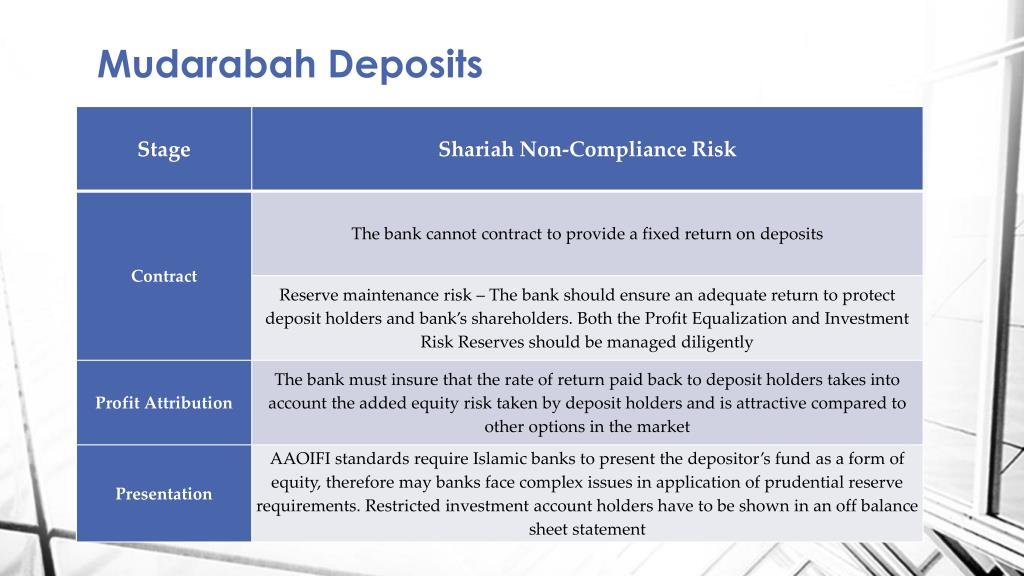

The shariah compliance of a product is determined primarily by looking at the shariah compliant status of its underlying contract. Shariah compliance as discussed in the previous articles is very broad in scope covering every operational angle of an islamic financial institution s activities. Shariah compliance is the backbone of islamic financial institutions in assuring their reputation and credibility it is a unique characteristic of. Islamic banks shall at all times comply with the shariah.

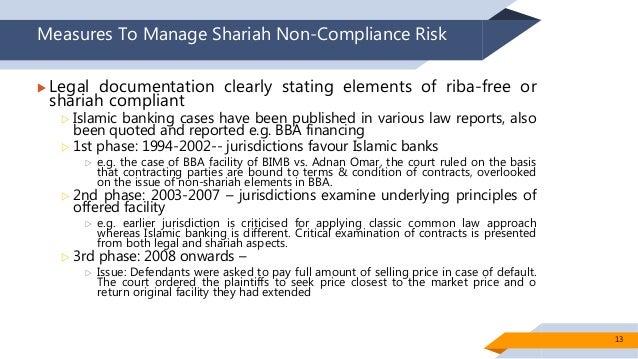

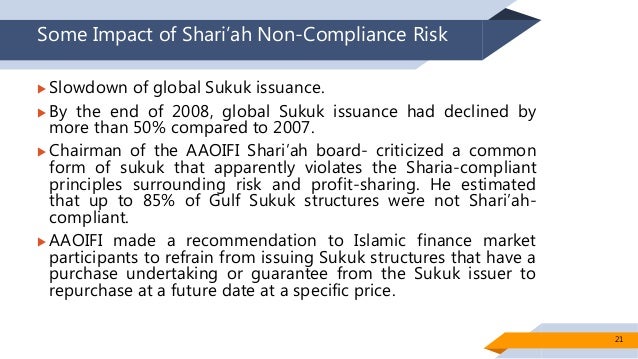

This study is conducted through a literature review on islamic. The effective management of shariah non compliance risk is therefore paramount especially with the growing signifi cance of islamic fi nance as a key component of the fi nancial system domestically and globally. This article highlights the approach by the bank and the practices of. Shariah risk ratings non comply totally contravene with shariah principles or the s s rulings or sa decisions or does not have shariah unit s sign off or approval.

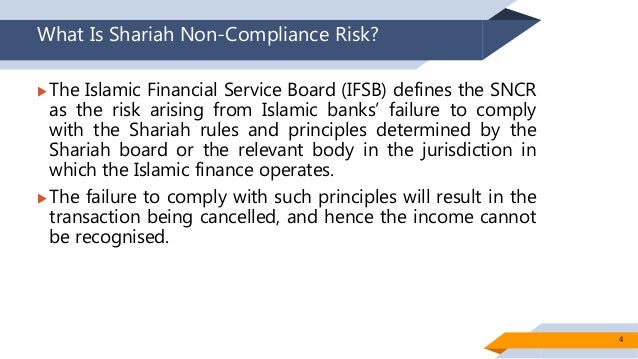

Shariah non compliance risk has been defined as the risk that arises from the bank s failure to comply with the shariah rules and principles determined by the relevant shariah regulatory councils islamic financial services board ifsb. Sidc cpe accredited. Isdb maintains top aaa rating as risk profile remains very strong over the medium term. Shariah non compliance risk in islamic banks islamic banks are exposed to risk relating to shariah non compliance risks and also to reputational risk.

The objective of this paper is to provide the definition of shariah non compliance risk associated with islamic financial institutions ifis. Build your own report. Having a precise definition of shariah non compliance risks is highly necessary for the purpose of developing a comprehensive risk management framework for an islamic financial system.