Types Of Sukuk In Malaysia

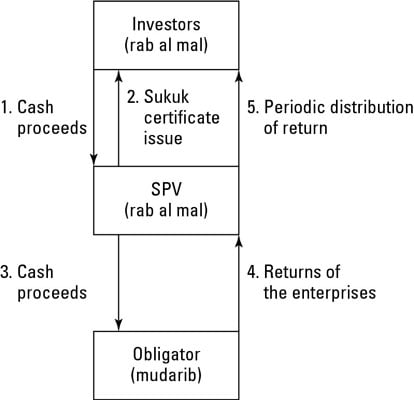

The working partner is the sukuk obligator.

Types of sukuk in malaysia. Unrated medium term note programme. Explain the differences between asset based and asset backed sukuk. The sukuk obligator as the working partner is generally entitled to a fee and or share of the profit which is spelled out in the initial contract with. But i did come across this interesting presentation on the types of sukuk.

The islamic development bank is one of the major issuers of sukuk in malaysia. This article sets out 7 types which are mostly used in malaysia sukuk market. Discuss the legal and shariah implications of the different types of sukuk. Around 78 of the sukuk issued in malaysia were issued by private corporations while the other 22 were sovereign islamic securities the asset.

With her permission i attached herewith the presentation on sukuk in pdf for your easy download. There are two main types of sukuk issued in malaysia. Proceeds from this offering will be used by the gom for shariah compliant general purposes specifically for the redemption of wakala global sukuk berhad s us 1 2 billion trust certificates due in july 2016 as well as to finance. These are the wakala sukuk and the murabaha sukuk.

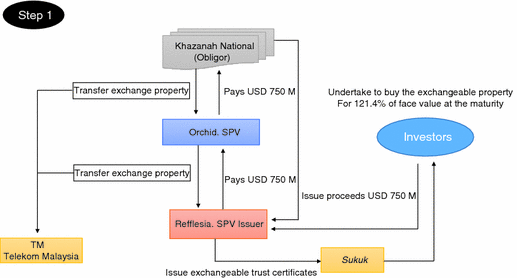

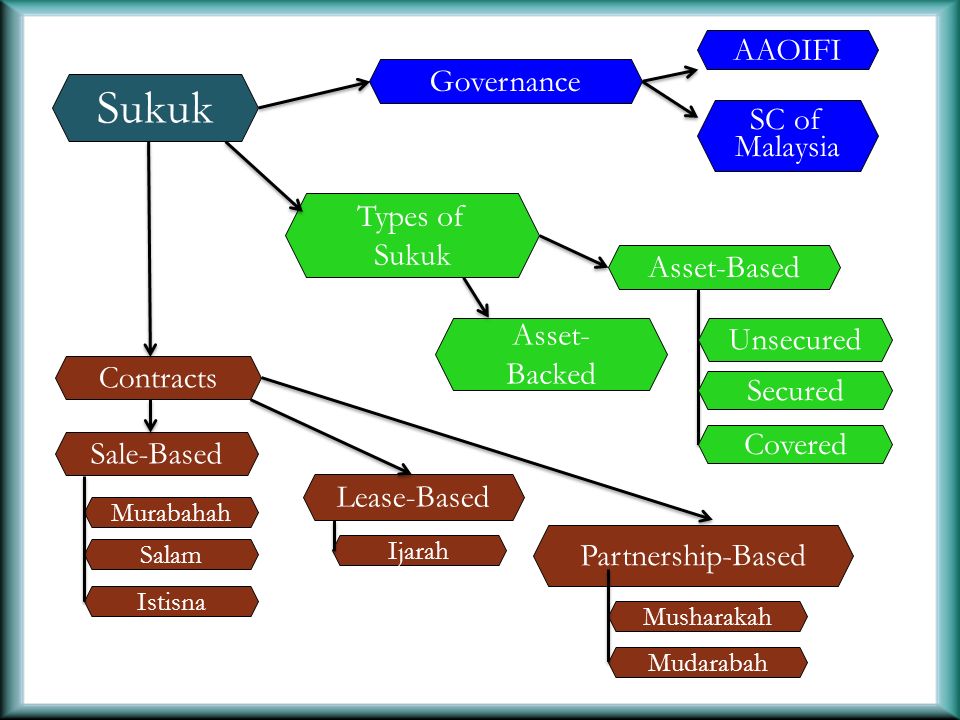

Shariah issues in sukuk aaoifi. The sukuk structures set out in this article rely on the creation of a special purpose vehicle spv. The same type of contract applies to sukuk. Senior sukuk murabahah and or subordinated sukuk murabahah programme.

Sukuk and bonds are two kinds of financial instruments that share the malaysian capital market. Click here to read types of sukuk pdf format. Describe the shariah and corporate governance issues in relations to the different. In a mudaraba sukuk the sukuk holders are the silent partners who don t participate in the management of the underlying asset business or project.

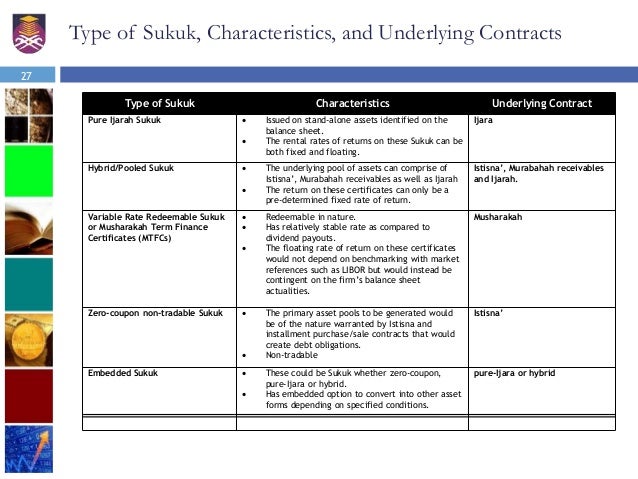

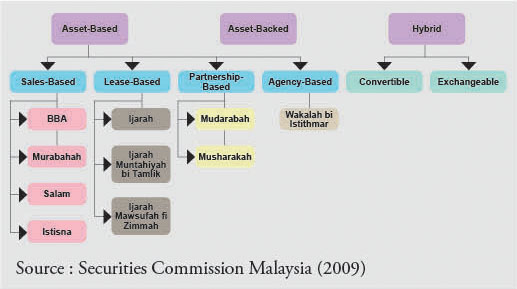

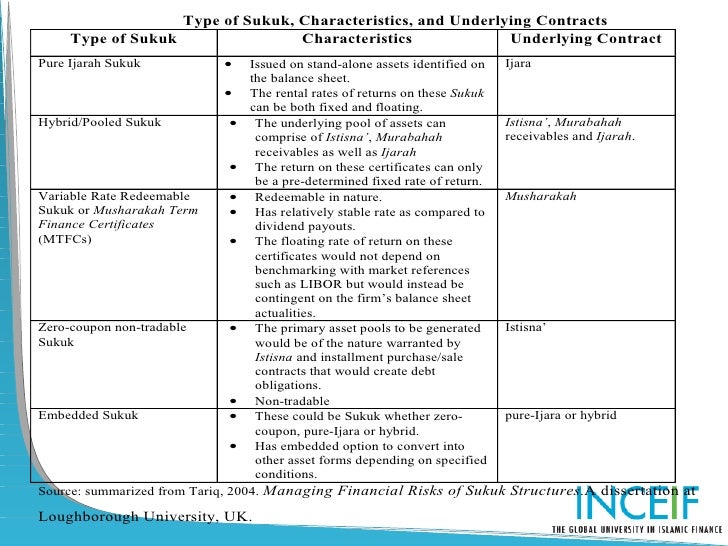

A presentation i saw on linkedin by camille paldi on the types of sukuk provides an excellent introduction to the subject. This offering marks the gom s fifth usd denominated global sukuk issuance following the gom s successful global sukuk issuances in 2002 2010 2011 and 2015. This chapter provides a general discussion on the types of sukuk particularly their classification and structures in the islamic capital market icm in the icm sukuk can be classified into two different categories. Hunza properties penang sdn bhd.

A special purpose vehicle or spv will issue sukuk which represent an undivided ownership interest in an underlying asset transaction or project. The first classification is based on the type of structure such as asset based or asset backed whereas the second classification is based on specific shariah contracts.